Why Macro Suddenly Matters So Much for Crypto

If you were in the market back in 2017, you probably remember that nobody cared about CPI prints or Fed meetings — it was all about whitepapers and Telegram groups. Fast‑forward to 2025, and ignoring macro is one of the fastest ways to get liquidated. The big money in crypto now is hedge funds, treasuries, HFT desks; they live and die by macro. When US 2‑year yields jump 20–30 bps in a day, you can literally watch BTC perpetual funding flip from positive to sharply negative within hours. That’s why any serious trader needs a mental framework for how macroeconomics affects cryptocurrency prices, instead of just reacting to headlines on X five minutes too late.

Rates, Liquidity and Why Bitcoin Trades Like a Tech Stock

The first macro pillar for crypto is the level and direction of real interest rates. In simple terms: when “risk‑free” yields (like US 2‑year Treasuries minus inflation) are high and rising, holding volatile assets like BTC becomes less attractive. From 2022 to late 2023, the US 10‑year moved from ~1.5% to over 4.5%, and Bitcoin repeatedly sold off after each hawkish Fed surprise. Conversely, when markets start to price cuts — think early 2024 after several weaker‑than‑expected payrolls and softer core PCE — Bitcoin often front‑runs that easing. BTC rallied from the low 40k area to above 60k as futures implied roughly 100 bps of cuts over the next year, even while spot equity flows were still cautious.

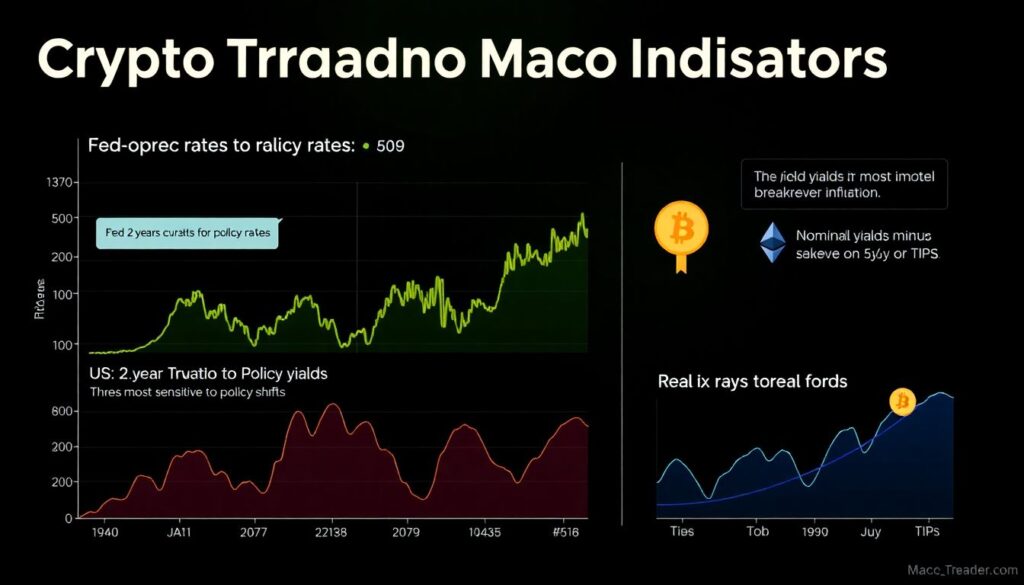

Technical block: Key rate indicators to watch

For crypto trading macro indicators around interest rates, three data streams dominate: the Fed funds futures curve (what the market expects for policy rates), the US 2‑year yield (most sensitive to policy shifts) and real yields (nominal minus breakeven inflation, usually tracked via 5y5y or TIPS). When Fed funds futures add an extra 25–50 bps of expected hikes over a week, you usually see an immediate repricing in BTC and ETH implied volatility, with skew tilting toward puts. Conversely, a sudden drop in the 2‑year yield of ~15–20 bps intraday often precedes a sharp short‑covering rally in majors as systematic funds unwind short gamma positions triggered by lower rate volatility.

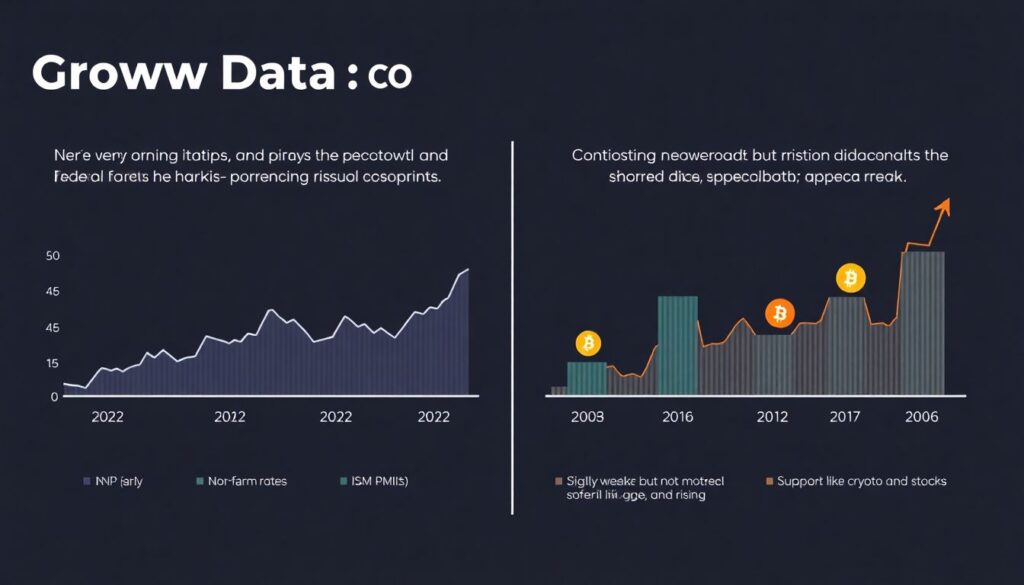

Growth and Employment: “Good News Is Bad News” Regime

The second pillar is growth data: NFP (non‑farm payrolls), unemployment rate, ISM PMIs, and GDP prints. Since 2022, we’ve been in a regime where “too strong” growth keeps the Fed hawkish, which can pressure crypto, while “slightly weaker but not disastrous” data often helps risk assets. For example, on 2 February 2024, a blowout US jobs report with unemployment near 3.7% and strong wage growth sparked a quick 5–7% intraday pullback in BTC and ETH. The logic: strong labor means persistent inflation risk, fewer cuts, tighter financial conditions. But when ISM services dipped below 50 later that year, Bitcoin spiked as traders priced a softer growth path without immediate recession risk, leaning into the “Goldilocks” narrative that favors digital assets.

Technical block: Reading data vs. expectations

When you do crypto market analysis using economic data, the absolute level of the indicator is less important than the surprise versus consensus. Markets trade the delta. If NFP prints 180k while consensus was 250k, that’s a negative growth surprise, even though 180k is not “bad” in isolation. Bloomberg/Refinitiv consensus acts as the anchor: a one‑standard‑deviation miss on jobs or ISM often moves front‑end rates enough to trigger automated flows in BTC futures. A practical rule: pay closer attention when the surprise index (like the Citi US Economic Surprise Index) flips trend; in 2023, sustained negative surprises in that index coincided with multiple local bottoms in BTC as rate expectations eased.

Inflation: The Monthly CPI Trade

Inflation releases have turned into scheduled volatility events for crypto. CPI, PCE, and sometimes wage components from the jobs report can shift the entire rate path in one morning. Between 2022 and 2024, several CPI prints produced 8–12% peak‑to‑trough ranges in BTC in less than 24 hours. When core CPI came in 0.2 percentage points below expectations more than once in mid‑2023, markets started to bet that the inflation shock was behind us, feeding into the big risk‑on rotation that later helped BTC reclaim the 30k and then 40k levels. Conversely, any upside surprise after a benign streak tends to crush high‑beta altcoins first, as they’re the levered expression of risk sentiment.

Technical block: Inflation expectations and breakevens

Beyond headline CPI, advanced traders monitor inflation expectations via breakevens (differences between nominal and inflation‑linked bonds) and swaps. For best macro indicators for bitcoin trading, 5‑year breakevens and 5y5y inflation swaps are particularly relevant: a steady downtrend in these often correlates with lower macro volatility and a friendlier backdrop for carry trades in crypto. When breakevens are stable or drifting lower while real yields are also no longer rising, options markets in BTC typically see realized volatility compress, which encourages funding‑positive basis trades and can grind spot prices higher as market makers hedge their exposure over time.

The Dollar, Global Liquidity and Stablecoins

Crypto is still largely dollar‑centric, so the DXY index and global USD liquidity matter. A strong, rapidly appreciating dollar usually tightens financial conditions for the rest of the world, which can force de‑risking in emerging markets and, by extension, crypto. In late 2022, the DXY near 114 coincided with one of the ugliest drawdowns across risk assets. As the dollar weakened through 2023–2024, capital flowed back into carry and momentum strategies in BTC and ETH. On‑chain data showed increasing stablecoin inflows to exchanges during periods when DXY trended lower, reinforcing the idea that FX and cross‑border liquidity directly shape crypto’s bid.

Technical block: Monitoring liquidity and flows

To quantify liquidity for crypto trading macro indicators, traders combine global M2 trends, reverse repo balances, and central bank balance sheet data with on‑chain metrics. When the Federal Reserve and ECB both expanded balance sheets during stress episodes (e.g., regional banking concerns in early 2023), BTC reacted positively even though risk sentiment was shaky, because excess liquidity sought liquid, 24/7 markets. Watch for inflection points: a slowing pace of quantitative tightening, or even verbal hints at balance sheet flexibility, tends to support the medium‑term bull case for crypto, especially when accompanied by net positive stablecoin issuance and rising open interest on major derivatives venues.

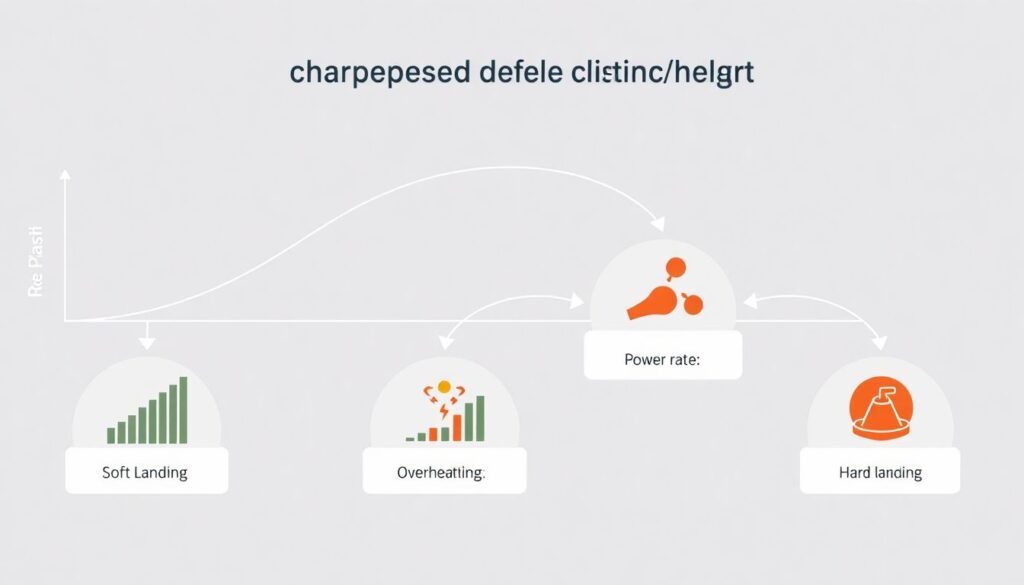

Putting It Together: A Practical Macro Playbook

Instead of viewing each data point in isolation, you want a simple framework. Start from the rate path: are cuts being priced in faster or slower? Layer in growth: are surprises pointing toward soft landing, overheating, or hard landing? Add inflation: are risks skewed to upside or downside? Finally, check the dollar and liquidity. If you see a cluster of dovish developments — slowing inflation, modestly softer growth, stable dollar, easing credit spreads — that’s usually a constructive setup for BTC and large caps. In that environment, many desks lean into trend‑following and vol‑selling strategies, expecting mean‑reversion in dips rather than full‑scale regime change.

Technical block: Trading the news vs. trading the regime

A solid guide to trading crypto on macro news distinguishes between short‑term volatility trades and structural positioning. Around big events (CPI, FOMC, NFP), you can trade the immediate reaction via options straddles, tight stop futures scalps, or basis trades. But the real PnL for most professionals comes from aligning with the regime: is the Fed in a prolonged easing cycle, is fiscal policy expansionary, is credit stress rising? Backtests from 2016–2024 show that Bitcoin’s 6‑month forward returns are markedly better when the Fed is either on hold or cutting, inflation is trending down, and US financial conditions indices are easing. News trades are about minutes and hours; regime trades are about weeks and months.

2025 and Beyond: How This Macro–Crypto Link Will Evolve

Looking ahead from 2025, the macro‑crypto relationship is likely to deepen, not fade. Sovereign adoption experiments, tokenized treasuries and real‑world asset protocols mean that crypto is getting pulled further into the global funding system. As more governments issue tokenized debt and big asset managers run on‑chain strategies, the sensitivity of BTC and ETH to rate shocks and liquidity swings should increase. At the same time, if Bitcoin continues to mature as a “digital macro asset,” it may start behaving more like gold: less hyper‑reactive to every data print, more responsive to slow‑moving trends in real yields and fiscal sustainability. Understanding how macroeconomics affects cryptocurrency prices today is essentially training for a world where crypto is just another, very fast, leg of the global macro complex.

Technical block: Future indicators to add to your dashboard

Over the next few years, expect new signals to matter: tokenized T‑bill yields, stablecoin velocity, on‑chain lending rates, and cross‑margin data from institutional prime brokers will all become part of standard crypto market analysis using economic data. As central banks experiment with CBDCs and programmable money, policy shocks could transmit to crypto almost instantly, tightening the feedback loop between macro and digital assets. The edge will go to traders who can synthesize these on‑chain signals with legacy indicators like PMI, breakevens, and yield curves, instead of treating crypto as an isolated casino. The macro theme is not a temporary narrative — it is the structural context in which the next decade of crypto price discovery will unfold, especially for those searching for the best macro indicators for bitcoin trading across evolving markets.