Why “cheap” on-chain transactions aren’t actually cheap

The illusion of low fees and where the real money leaks

When people make their first on-chain transfers, they usually stare at one number only: the network fee shown in the wallet. It might look tiny, especially in quiet hours, and that creates a trap — you focus on the visible gas cost and ignore everything else happening around the trade. In reality, the hidden costs are spread across slippage, spreads, token approvals, bridge commissions, withdrawal fees from exchanges, and even your own impatience when you push a transaction during network congestion. To properly estimate the total expense of a transaction, you have to think in terms of “all in”: from fiat in to fiat out, including every micro‑fee and every price deviation you accept along the route. That’s where most beginners bleed value without noticing it, because they never sum up every leg of the path.

Why beginners underestimate gas and overpay without noticing

A classic beginner mistake is to zoom in on one metric: “gas price looks low, so I’m fine.” They don’t realize gas has two parts: the base fee paid to the network and any priority tip added to miners or validators, plus the variable gas limit that depends on transaction complexity (swaps or NFT mints consume far more than a simple transfer). On top of that, they overlook token approval costs: each new DeFi protocol usually requires a separate on-chain approval, which is an extra transaction. Perform multiple small swaps and you’ll pay approvals and execution fees again and again, each time eating into your capital. Estimating hidden costs starts with mapping how many on-chain operations you’re really triggering, instead of assuming it’s “just one transfer” because the front-end user interface looks simple.

Real-world cases: where hidden costs quietly add up

Case 1: The “cheap” DeFi swap that lost to a centralized exchange

Imagine someone wants to convert USDC to ETH and thinks using a DEX is automatically cheaper because “no middleman.” They open a web DApp, connect a wallet, and proceed with a swap during moderate network usage. On paper, the visible fee is a single gas figure, but in reality this user pays for two approvals (USDC and the router), then the swap transaction itself, each with its own gas consumption. Add a bit of slippage because the chosen pool is not very liquid, and maybe a sandwich attack that worsens execution price by a fraction of a percent. Once you total everything, the user might lose more than they would have paid on one of the best low fee crypto exchanges, where liquidity is deeper and maker–taker fees are clearly documented. What looked like a decentralized bargain becomes more expensive once all implicit costs are added and compared.

Case 2: Cross-chain bridge hopping versus native transfers

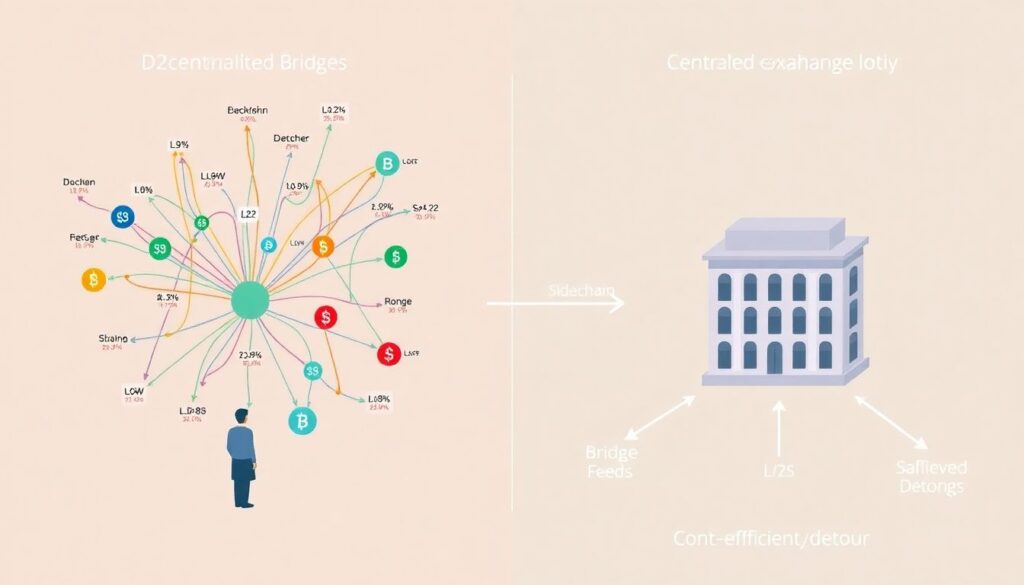

Another frequent scenario involves moving funds from one chain to another. A beginner discovers a bright, user‑friendly bridge interface, sees a small displayed fee, and assumes that’s the total cost of their cross‑chain journey. In practice, there are often extra layers: an L1 withdrawal fee, a bridge protocol fee, a gas payment on the target chain to claim or unwrap tokens, and potentially a bad exchange rate if the bridge performs an internal swap from one wrapped asset to another with a poor quote. Sometimes it’s even cheaper to use centralized cheap bitcoin and ethereum transfer services as an intermediate hop: deposit on one exchange, withdraw on the target chain or network with a fixed and transparent fee. The hidden price of convenience in many bridges is a little skim on every conversion, which is rarely front and center in the UI but clearly visible when you carefully reconstruct your before‑and‑after balances.

How to systematically estimate hidden costs

Building a mental “full path” model for every on-chain action

To truly estimate hidden costs, you should model every transaction as an ordered path with nodes and edges: where the funds enter, which smart contracts they touch, which networks they cross, and where they finally exit. Each step has a measurable component: gas consumed, protocol fee, spread, and slippage. Instead of reacting to whatever your wallet shows in the confirmation dialog, write down the expected final balance before you even hit confirm, then re‑check after the transaction is mined. The delta shows you the real cost. Repeat this across multiple setups and you will quickly develop intuition for expensive paths. Over time, you start recognizing patterns: certain routers overestimate price impact, some bridges add an invisible spread, and some staking contracts front‑load costs in the initial deposit. The key is adopting a habit of treating on-chain flows as a series of separate fee events, not a single opaque operation.

Using analytics tools beyond a simple gas estimator

Most newcomers use whatever “gas tracker” widget is built into their wallet and stop there. That’s not enough if you care about hidden costs. You need tools that break down where your money actually goes, such as block explorers with internal transaction traces, or DEX aggregators that reveal slippage, routing decisions and on‑chain quotes compared to off‑chain reference prices. Some dashboards even approximate MEV and sandwich attack exposure by comparing your execution price to the mid‑price right before and after the transaction. When you combine these analytics with projections from a crypto transaction fees calculator, you can simulate scenarios like “batching ten small transfers into two larger ones” or “moving liquidity during off‑peak hours,” observing how costs change over time. Beginners often ignore these resources, but using them is what separates transaction tourists from people who actively manage execution risk and total expenditure across the entire operation.

Non-obvious ways to cut hidden costs

Optimizing transaction timing, batching and routing

One underrated technique for how to reduce gas fees on blockchain transactions is simply respecting time: gas markets behave like any other market, with peaks around major NFT mints, token launches or macro news events. If your transaction is not time‑sensitive, you can save a lot by using a lower priority fee and letting the transaction sit in the mempool until congestion eases. Additionally, batching actions matters; instead of doing three swaps in a row converting token A to B to C, use an aggregator that finds a single multi‑hop route and executes it once, consuming less total gas and often delivering a tighter price. With some protocols, it’s cheaper to deposit stablecoins directly into a yield vault than to buy a vault token on a DEX, even if the UI feels more complex. Non‑obvious routing — like going through a highly liquid stablecoin pair before moving into a volatile asset — can sharply reduce price impact and hidden spread.

Reducing approval overhead and avoiding redundant interactions

Token approvals are a classic source of silent drains, especially for users who constantly chase new farming opportunities or airdrop qualifiers. Many wallets default to “infinite” approval for smart contracts, which is convenient but unsafe and often unnecessary; however, setting very low limits leads to frequent re‑approvals, each with its own gas expense. The compromise for advanced users is to grant per‑protocol allowance that covers realistic usage for a few months and then periodically revoke unused approvals with a dedicated tool, budgeting a small amount of gas for hygiene instead of random overhead. Another pattern is to avoid interacting with multiple DApps that rely on the same underlying protocol when one interface already offers all the functions you need. Each front‑end might prompt an extra approval or configuration step. Streamlining which contracts you actually trust and touch helps reduce not only smart contract risk but also the cumulative hidden cost of redundant set‑up transactions.

Alternative methods to move value more efficiently

Centralized detours: when CEX routes are cheaper and safer

There is a strong ideological bias against centralized exchanges in crypto, but if you care about minimizing real‑world costs, sometimes a short centralized detour is rational. For instance, moving funds from one L2 or sidechain to another via a bridge can be surprisingly expensive when you include bridge fees, gas on both chains, and worse pricing on illiquid pairs. In such cases, sending assets to a major CEX, swapping in a deep order book, and withdrawing to the target network can be more efficient, especially when you take a moment to compare crypto wallet fees and charges with the published deposit and withdrawal schedules of your exchange. You sacrifice some self‑custody for a brief window, but you might save a significant percentage of your capital on large transfers. The critical step is to map both paths and compute all-in costs, rather than defaulting to one model out of habit or ideology.

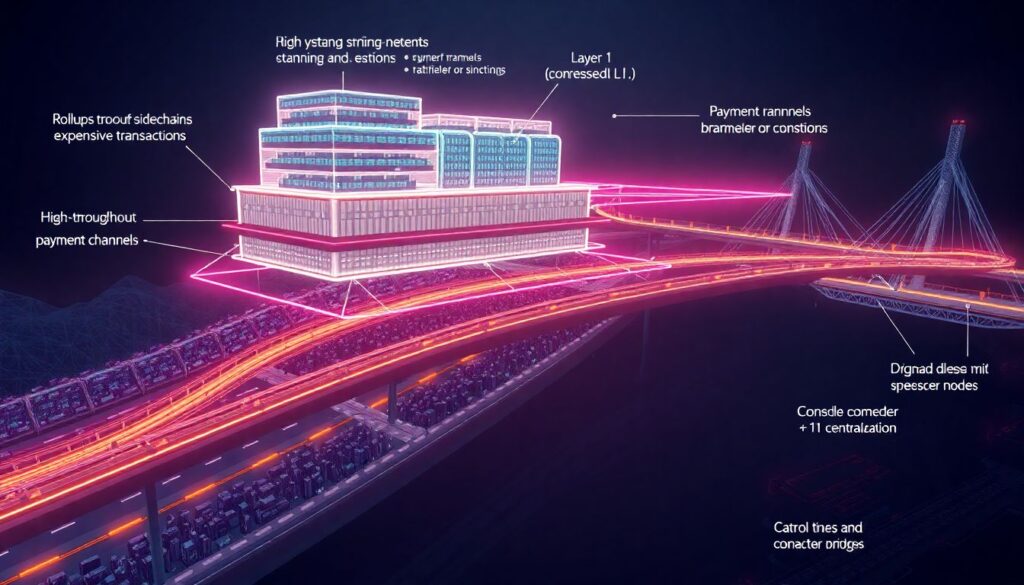

Layer 2 networks, sidechains and payment channels

Another alternative method is to change the environment instead of fighting the fee structure on a congested L1. Layer 2 rollups, high‑throughput sidechains and payment channels drastically lower per‑transaction gas, but they introduce their own hidden considerations, such as bridge exit times, sequencer fees, or risks tied to operator centralization. If you do many small transfers — like paying freelancers or rebalancing trading bots — running these operations on a cheaper network and only occasionally settling back to the main chain can dramatically lower your average cost per transaction. Just remember to factor in the cost of bridging in and out, plus any liquidity provider fees involved in wrapping and unwrapping tokens. For frequent users, the aggregate savings often justify the one‑time migration costs, but beginners rarely run that calculation and stay stuck paying premium gas on the busiest chain simply because “that’s where everyone is.”

Pro-level tricks and mindset shifts

Professional hacks for monitoring and minimizing total cost

Experienced on-chain users treat fees like traders treat spreads: they’re an execution variable to be actively managed. They monitor mempool conditions, set custom gas parameters instead of default presets, and use automation scripts to submit or cancel transactions based on live fee data. Many pros log every substantial transaction in a spreadsheet or internal dashboard, recording: gas spent, execution price versus mid‑price, and any additional protocol fees. Over weeks, this creates a personal dataset showing which DEXes, routes and tools are consistently cheaper in practice, not just in marketing copy. Likewise, they occasionally sanity‑check on-chain operations against off‑chain alternatives, including cheap bitcoin and ethereum transfer services when moving funds across exchanges or between custodial accounts. By normalizing these habits, professionals not only save money per trade but also uncover systematic inefficiencies in their own workflows that casual users never even realize exist.

Learning from mistakes and building your own fee model

Newcomers often repeat the same patterns: they chase hype mints at peak gas times, trust default wallet settings, ignore slippage warnings, and never verify final balances against expectations. The way out is to treat every costly mistake as data, not bad luck. After an expensive transaction, reconstruct it: inspect the block explorer, note exact gas used, see how the price moved between signing and inclusion, and identify every contract you interacted with. Then ask yourself which parts could have been optimized: different time, chain, route or interface. Over time, you can develop a personal fee model tailored to your usual activities — trading, yield farming, NFT collecting, or cross‑chain arbitrage. Whether you rely on a simple crypto transaction fees calculator or a custom script that combines historical gas charts with slippage estimates, the goal is the same: anticipate total cost before committing capital, rather than discovering it only after the transaction is irreversibly written to the blockchain.