Category: AI Tools in Crypto

-

How to build a responsible Ai toolkit for crypto journalism and ethical reporting

Why crypto journalism needs its own AI playbook If you cover crypto, you already know how fast a rumor can pump a token and how slow corrections travel by comparison. Add generative models into this mix and you get a new risk layer: AI can draft a breaking story in minutes, but it can also…

-

Practical guide to event studies in crypto markets for data-driven investors

Why event studies matter in crypto (and why most people misuse them) If you’ve ever watched Bitcoin rip 12% in an hour after a random SEC headline and thought “there must be a pattern here”, you were already thinking in terms of event studies — just without the formal framework. In traditional finance, event studies…

-

Macroeconomic drivers of crypto markets and how to analyze key forces

Why macro suddenly matters so much for crypto If you traded crypto in 2016–2019, it often felt like a self-contained universe: narratives, halving cycles, ICO seasons, DeFi summers. Macroeconomics lived somewhere far away on Bloomberg terminals. That world is gone. Since 2020, crypto has been sucked into the same gravity field as stocks, bonds and…

-

Reusable crypto analytics components for faster blockchain data insights

Why reusable crypto analytics components actually matter From one-off scripts to real products Every crypto team I know starts одинаково: кто-то вбивает пару SQL-запросов к Dune или пишет Python-скрипт к API биржи, собирает пару графиков — и это «аналитика». Через месяц запросов уже десятки, метрик сотни, а crypto analytics dashboard components рассыпаются при каждом изменении…

-

How to create modular systems for cleaner, scalable and maintainable code

Modular thinking sounds fancy, but at its core it’s just the habit of breaking anything complex into clean, reusable blocks. Code, furniture, music gear, even your weekly schedule can be modular. When you learn how to create modular systems, you stop rebuilding from scratch and start composing from well‑designed parts. Newcomers usually do the opposite:…

-

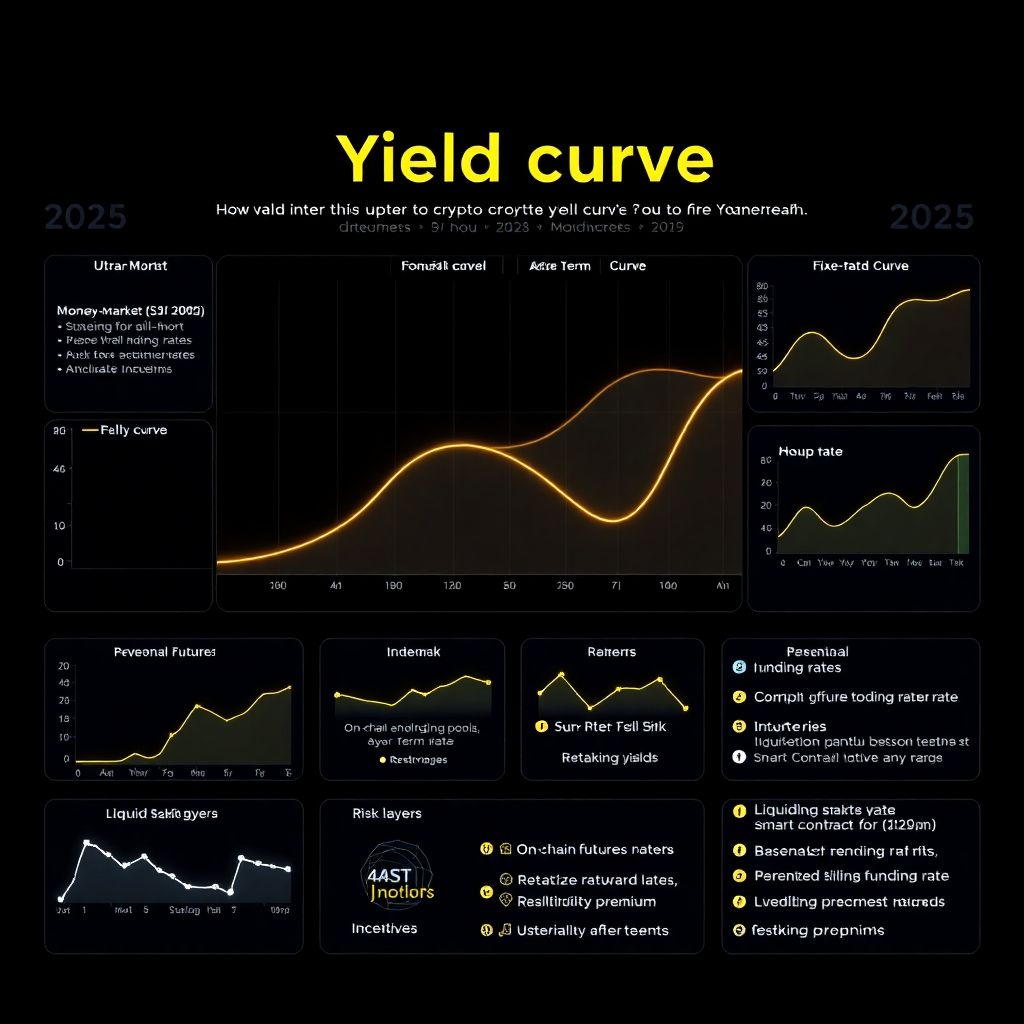

Interpreting yield curves in crypto markets for smarter investment decisions

Interpreting yield curves in crypto markets can feel mysterious at first, but once you see how rates at different maturities line up, a lot of the noise in DeFi suddenly starts to make sense. In traditional finance, the yield curve is mostly about government bonds; in crypto, it’s a moving snapshot of how the market…

-

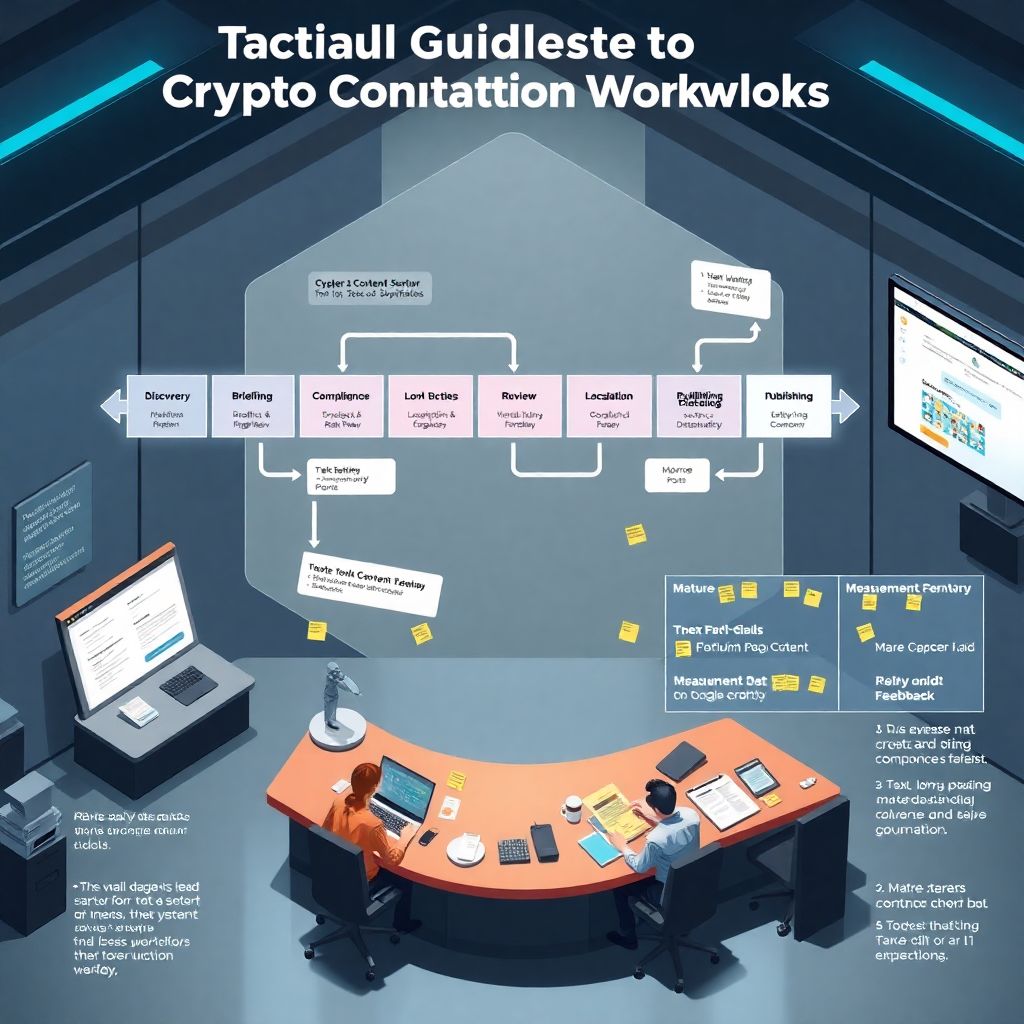

Tactical guide to crypto publication workflows for efficient content delivery

Tactical Guide to Crypto Publication Workflows in 2025 If you’ve tried to publish anything serious in crypto, you already know: the hard part isn’t just *writing* — it’s orchestrating ideas, approvals, compliance, channels, timing, and metrics across a messy, fast‑moving ecosystem. This is where a deliberate, tactical crypto publication workflow turns chaos into something predictable…

-

How to build a cross-asset crypto research framework for smarter investment decisions

Why a Cross‑Asset Crypto Framework Matters in 2025 Back in 2017–2020, most people treated crypto like a casino: pick a few coins, read Twitter threads, hope for the best. DeFi summer and the 2021 bull market added more complexity, but the thinking stayed mostly single‑asset: “Is this token going up or down?” Кросс‑активный подход появился…

-

How to build a reliable crypto market dashboard for real‑time trading insights

Why a reliable crypto market dashboard matters in 2025 In 2025 крипторынок уже не выглядит как хаотичная песочница из альткоинов и мем-токенов. Это огромная экосистема с деривативами, ончейн-аналитикой, токенизированными активами и гибридными DEX/CEX решениями. Если раньше хватало пары вкладок с CoinMarketCap, то сейчас без собственного crypto trading dashboard вы рискуете просто не успевать за потоком…

-

How to model the impact of regulatory events on crypto markets effectively

Why model regulatory impact on crypto at all? When a big piece of crypto regulation hits the news, prices often move faster than most dashboards can refresh, and that’s exactly why it makes sense to model the impact instead of guessing. Think of it this way: every major rule change is a shock to expectations…