Category: AI Tools in Crypto

-

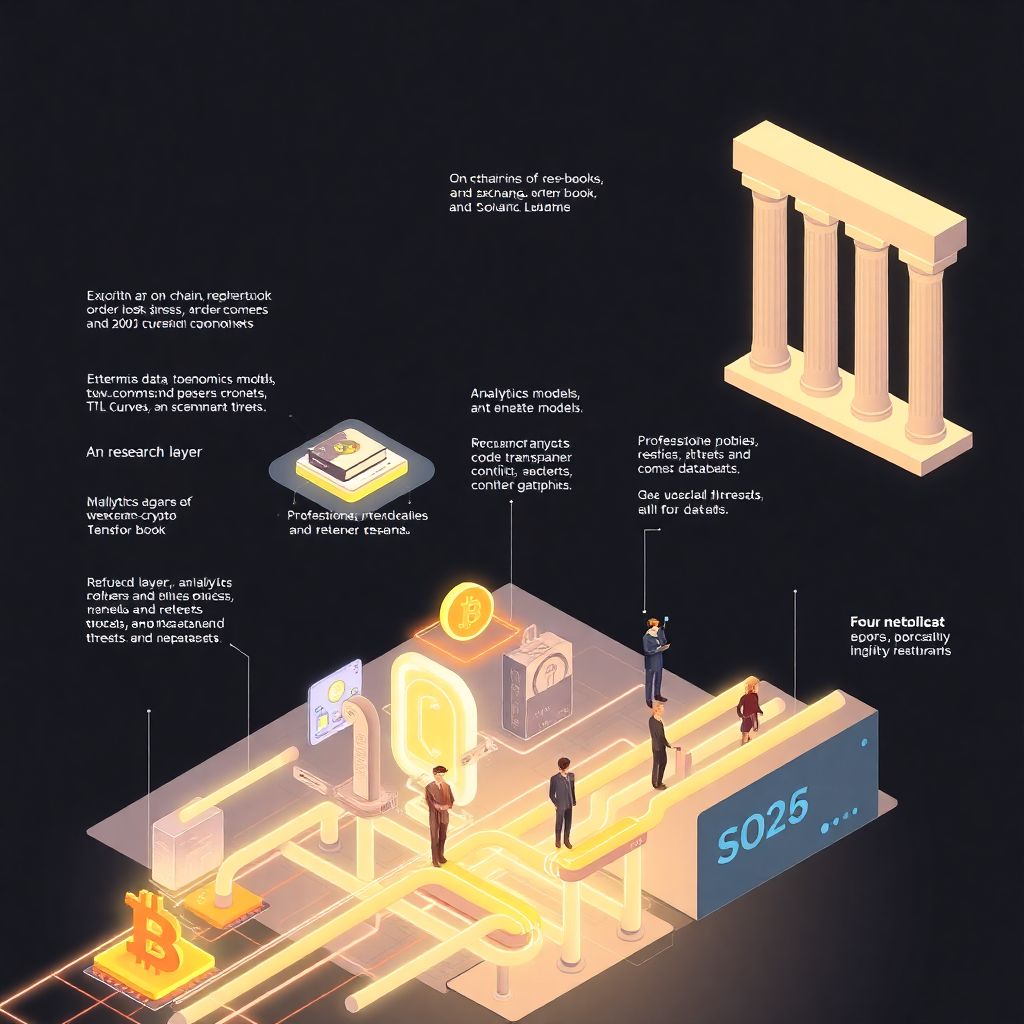

How to build a credible crypto research brand that investors truly trust

Why “credible” in crypto research suddenly matters By 2025, the idea of a “credible crypto research brand” is very different from what it was in 2017. Back then, most reports were glorified pitch decks for token sales, and even big names confused marketing with analysis. Today, after several boom‑and‑bust cycles, regulatory crackdowns and the collapse…

-

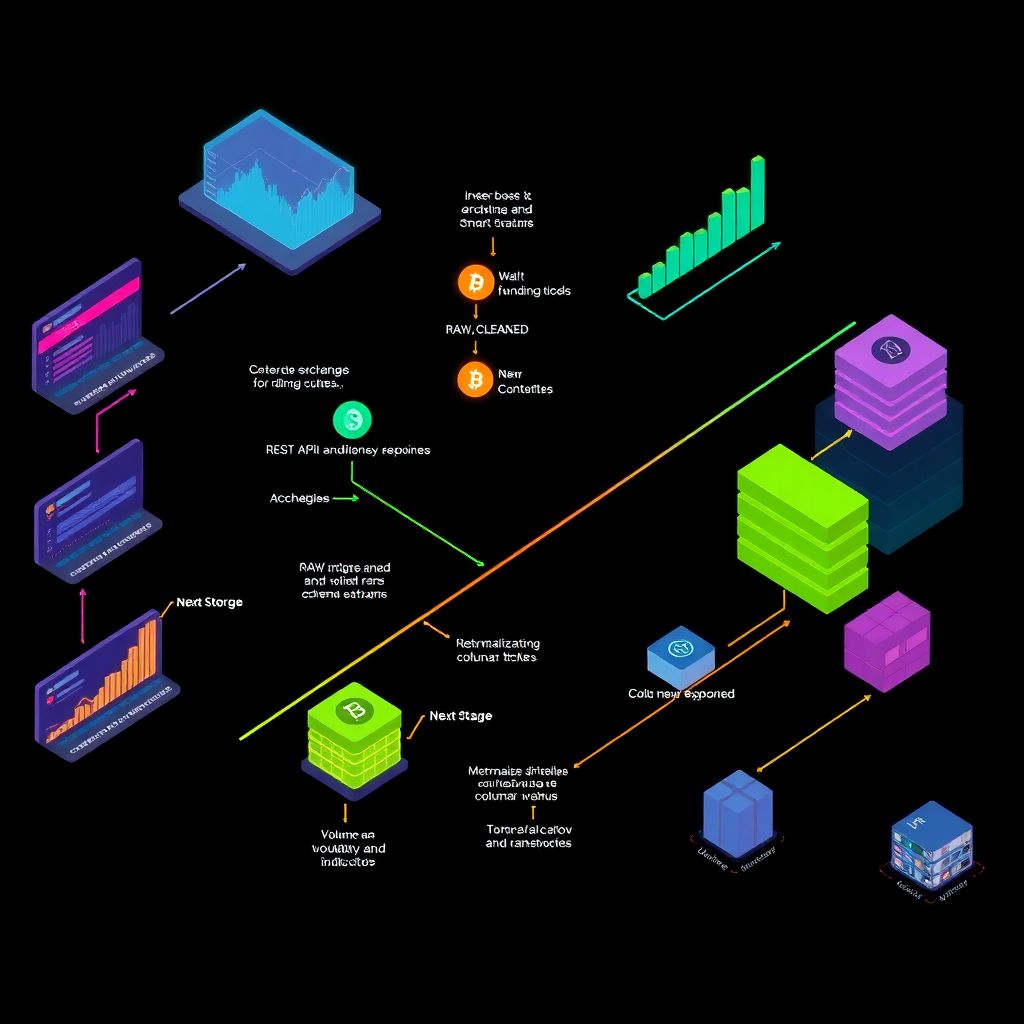

Crypto analytics pipeline: from data source to insight for better trading decisions

Why a Crypto Analytics Pipeline Matters More Than Ever Before diving into the “how”, it helps to understand *why* a proper crypto analytics pipeline is worth your time. Crypto markets move fast, are mostly API‑first, and generate insane volumes of on‑chain and off‑chain data. If вы просто скачиваете CSV из биржи и иногда обновляете график…

-

How to assess macro-driven crypto risk in volatile markets

Why macro risk matters for crypto right now If you trade or invest in crypto and ignore macro, you’re basically driving without looking at the road, только в зеркало заднего вида. С 2022 по 2024 годы цифровые активы перестали быть изолированным «крипто-островом» и стали гораздо более синхронно ходить с традиционными рынками. Корреляция BTC с Nasdaq-100…

-

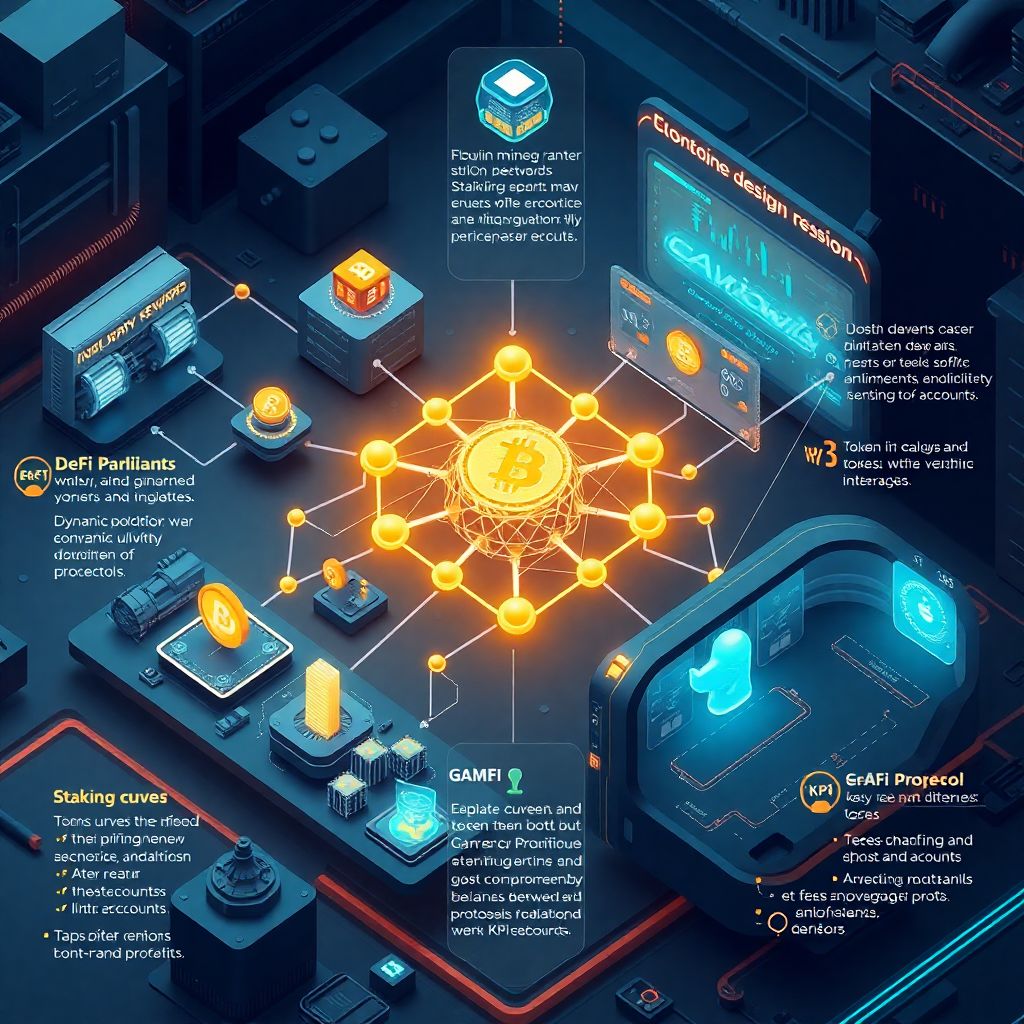

Guide to economic design of incentive mechanisms in crypto token economies

Why incentives matter in crypto more than anywhere else In crypto вы не можете просто “нанять модератора и дать ему инструкции”. Большая часть работы сетей — от валидации блоков до голосования в DAO — выполняется анонимными участниками, которых связывает только экономический интерес. Именно поэтому грамотный economic design — сердце любого протокола. Ошибка в стимулах превращает…

-

How to monitor compliance risk in crypto markets and strengthen your oversight

Why compliance risk in crypto is a big deal (and how not to ignore it) If you move money in crypto — even small volumes — you’re already in the game of compliance risk. It’s not just about regulators and banks. It’s about avoiding frozen accounts, de-platforming by exchanges, and being flagged by counterparties who…

-

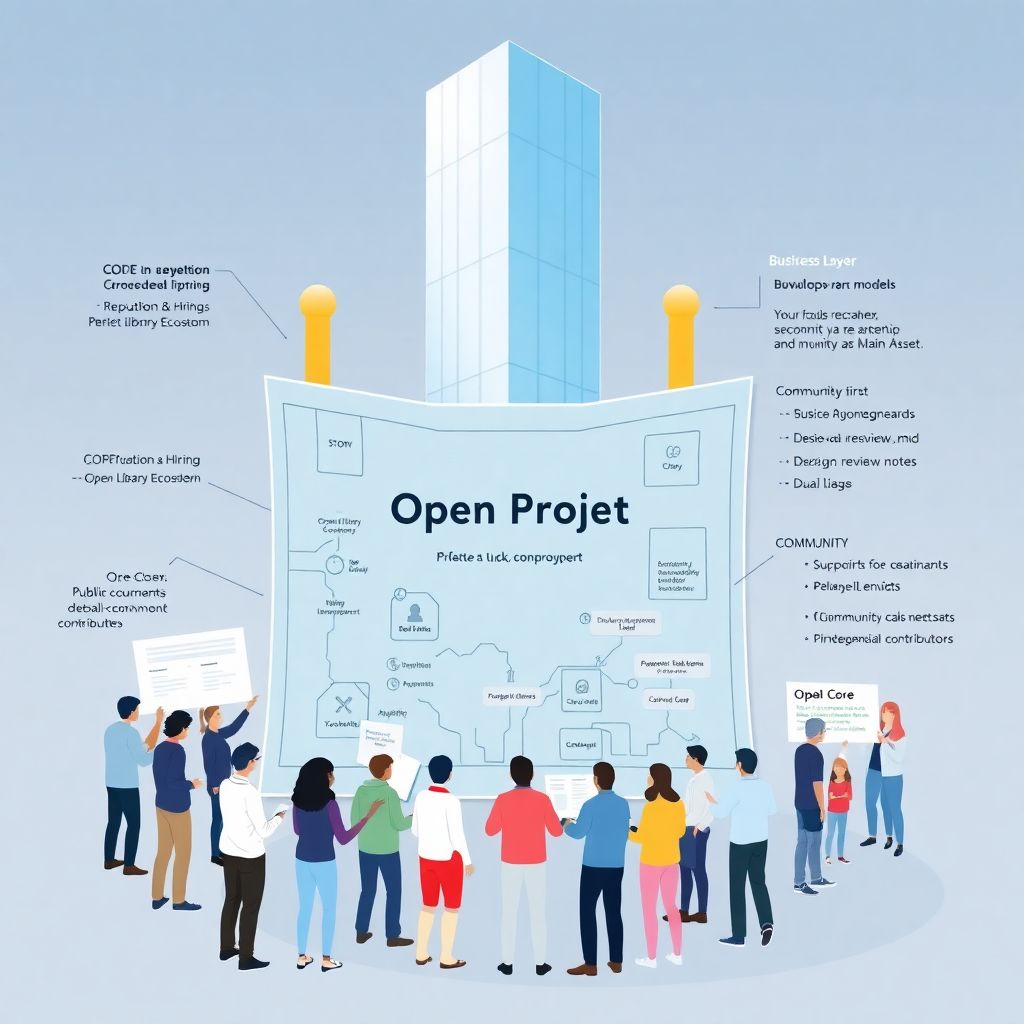

How to build an open platform from scratch: a practical guide for beginners

Why “building something open” is harder (and more rewarding) than it looks When people ask how to build an open project, они чаще всего имеют в виду «open source», но реальность шире: вы одновременно строите код, историю, экономику, культуру и сообщество. И всё это на глазах у публики, без привычной корпоративной стены. Ошибка в архитектуре,…

-

How to audit ai-generated research outputs for reliability and scientific rigor

Why AI‑generated research needs an audit trail AI models now draft everything from literature reviews to entire manuscripts, and in 2025 that’s normal in many labs. The problem is that large language models generate *plausible* text, not guaranteed truth. They can invent citations, subtly distort statistical claims and gloss over methodological caveats. If you publish…

-

How to estimate hidden costs in on-chain transactions and avoid losing money

Why “cheap” on-chain transactions aren’t actually cheap The illusion of low fees and where the real money leaks When people make their first on-chain transfers, they usually stare at one number only: the network fee shown in the wallet. It might look tiny, especially in quiet hours, and that creates a trap — you focus…

-

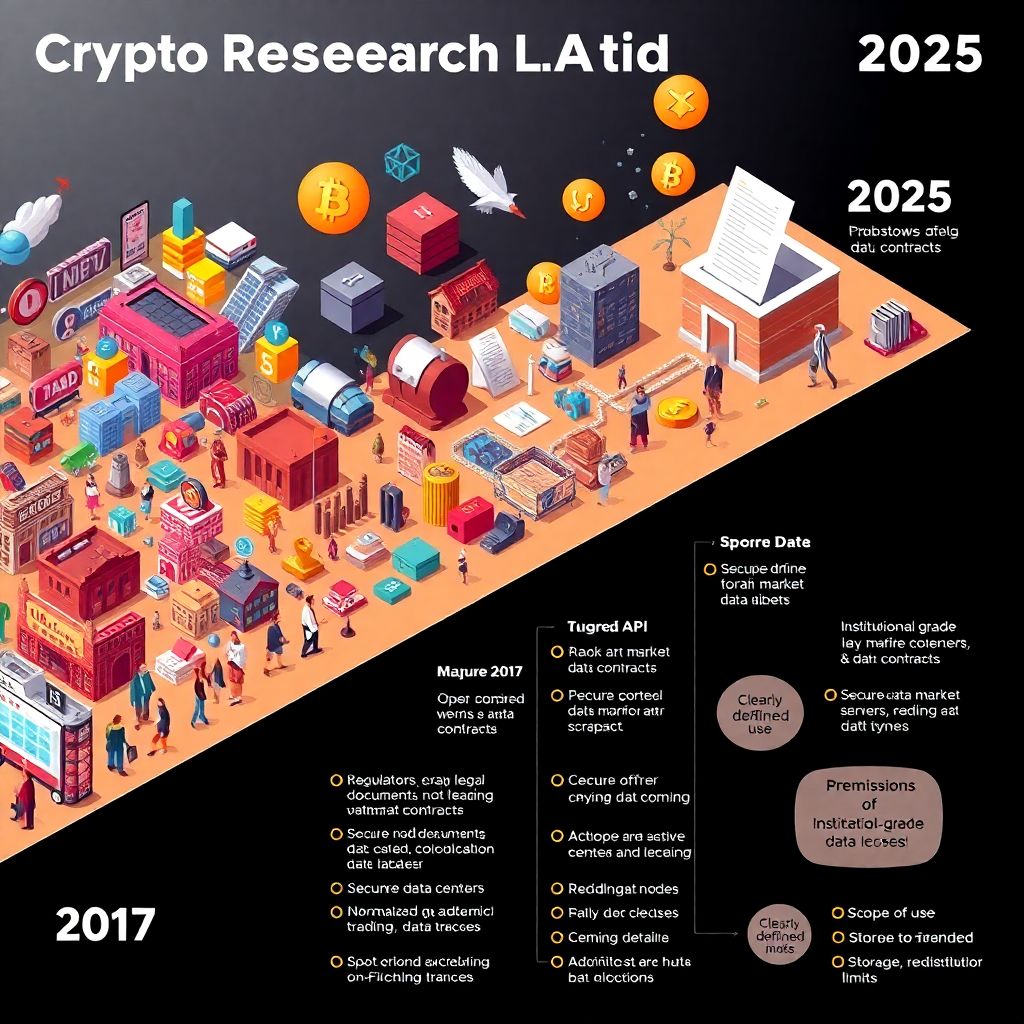

Navigating data licensing issues in crypto research for compliant, ethical studies

Why data licensing in crypto research suddenly got complicated If you were doing crypto research back in 2017–2019, you probably remember the wild west: dozens of free APIs, barely any rate limits, and essentially zero conversations about licensing. Fast‑forward to 2025 and the mood has changed dramatically. Exchanges delist coins overnight, regulators ask who owns…

-

Practical considerations for publishing crypto research on multiple platforms

Why publishing crypto research in 2025 is a very different game Crypto in 2025 is not the wild west it was in 2017–2021. Research has become a product. Funds pay five figures per month for solid on‑chain analytics. Retail traders buy niche reports. Protocols sponsor deep dives. And the same piece of work can (and…