Category: Market Analysis

-

Risk-adjusted performance metrics for crypto funds and how to use them

Кrypto is extremely good at fooling people with big numbers. A fund shows +300% for the year, and everyone rushes in — then half of that came from 5x leverage on illiquid microcaps that you couldn’t exit in a panic even if you wanted to. That’s why risk-adjusted performance metrics for crypto funds matter more…

-

On-chain metrics that matter for venture capital in crypto investing

In 2025, venture capital in crypto finally treats on-chain data as a first‑class signal, not a nice‑to‑have dashboard. Capital allocators care less about whitepapers and more about verifiable behavior: who uses the protocol, how sticky that usage is, and how value flows between wallets, contracts and bridges. The best on-chain metrics for crypto investment funds…

-

Simplified guide to gas fees and price impact in crypto trading

What gas fees and price impact actually are Gas fees and price impact sound scary, but they’re just two different “costs” you pay when trading crypto. Gas is the fee you pay to the blockchain network for processing your transaction. Think of it as paying a toll on a busy highway: the more cars, the…

-

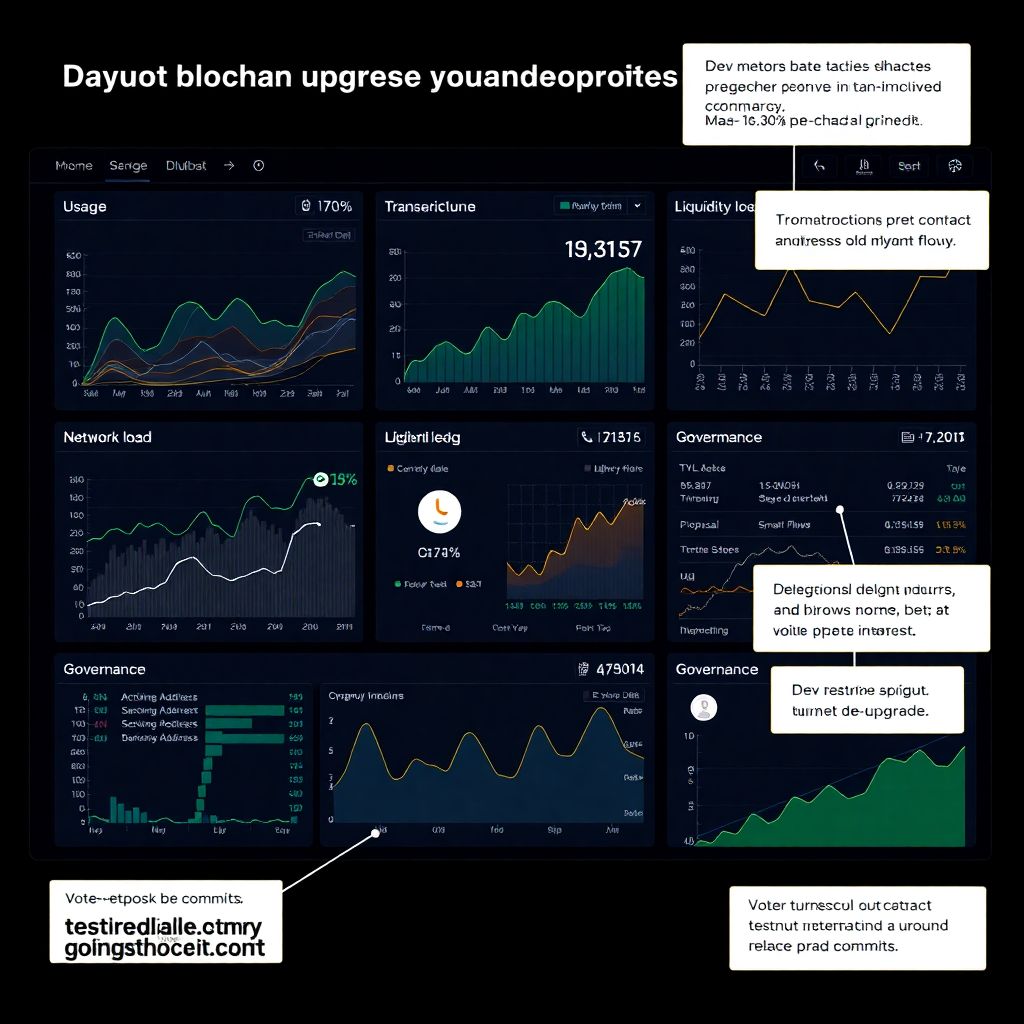

On-chain metrics that closely correlate with major protocol upgrades

Why on-chain metrics and upgrades belong in the same conversation When a protocol ships a major upgrade, the chain usually “whispers” about it in advance: addresses move funds, governance warms up, and dev activity clusters around key contracts. If you learn to read those signals, ты stop guessing and start reasoning. Instead of chasing hype…

-

Defi protocol risk scoring models traders can trust for safer crypto trading

Why risk scoring in DeFi is such a big deal Most traders jump into DeFi thinking risk is just “APY vs rugpull,” but real danger hides in details: contracts, governance, liquidity games and opaque incentives. A proper defi protocol risk scoring model turns that chaos into something you can actually reason about: a set of…

-

How to detect liquidity mining signals in defi and spot profitable pools

Most people first meet liquidity mining through a flashy APY screenshot on Twitter, ape in, and only then wonder what signals they should have checked beforehand. Detecting good liquidity mining setups is less about magic indicators and more about reading a few core data points in the right order. Think of it as a checklist:…

-

Advanced visualization techniques for crypto analytics to uncover trading insights

Why visuals matter so much in crypto analytics Если вы уже пробовали анализировать рынок криптовалют через Excel‑таблицы и бесконечные биржевые графики, то наверняка чувствовали усталость глаз и информационный шум. Современные crypto analytics tools for traders давно вышли за рамки обычных свечных графиков: сегодня продвинутые визуализации помогают не просто «красиво рисовать», а быстро замечать поведенческие паттерны…

-

Mining vs staking economics: practical guide to crypto rewards and risks

Why mining vs. staking economics still matter in 2025 If you got into crypto after 2021, you probably hear more about staking than about loud GPU rigs in a hot garage. Yet the debate around crypto mining vs staking profitability is still alive, because both models reward you for securing a network, just in different…

-

Comparative study of popular defi lending protocols and their performance

Why DeFi lending still matters in 2025 DeFi lending протоколы пережили и DeFi Summer, и медвежий рынок, и регуляторное давление, но в 2025 году остаются основным источником ончейн‑доходности. Пользователям важна не только годовая доходность, но и реальный риск: смарт‑контракты, ликвидность, стабильность стейблкоинов, поведение ликвидаторов. Любой best DeFi lending platforms comparison сегодня уже не сводится к…

-

Deep learning for crypto price pattern recognition in trading and market analysis

Why deep learning suddenly matters for crypto pattern recognition If you traded crypto back in 2017–2021, «pattern recognition» usually meant drawing triangles on TradingView and hoping for the best. В 2025 всё выглядит совсем иначе: мощные модели deep learning реально анализируют миллионы свечей, стаканы, новости, твиты и даже on-chain данные, чтобы выцепить повторы в поведении…