Category: Новости

-

Blockchain analytics introduction for researchers: methods, tools and use cases

Blockchain analytics sounds intimidating, but for a researcher it’s basically: “spreadsheets, but supercharged with transparent ledgers.” Over the last three years, the field has quietly gone from niche crypto-forensics to a full‑blown data science playground. Market reports estimate that spending on blockchain analytics tools roughly doubled between 2022 and 2024, passing the billion‑dollar mark in…

-

How to identify and avoid survivorship bias in crypto research and investing

Why survivorship bias quietly ruins a lot of crypto research When people talk about “researching crypto”, they usually mean scrolling through charts of coins that are still alive. That’s exactly where survivorship bias sneaks in. You only see the tokens that survived long enough to show up on CoinGecko, in YouTube reviews or in your…

-

How to assess the reliability of different price feeds in crypto and financial markets

Why reliability of price feeds matters more than ever If you trade, build algos, or run any kind of fintech product, the quality of your price feeds quietly determines your P&L. Over the last three years (roughly 2022–2024), this has only become more obvious. Industry surveys and public reports show that: – demand for low‑latency…

-

How to design ai-assisted dashboards for crypto risk management

Designing AI‑assisted dashboards for crypto risk in 2025 is less about shiny charts and more about survival. Markets move faster, regulators are finally awake, and “eyeballing volatility” in a spreadsheet is a good way to blow up a fund. Below — a structured, practical walkthrough of how to design these systems so they’re actually usable,…

-

How to build and maintain a crypto data lake on a budget for maximum efficiency

Seeing the crypto data lake as a product, not a pet project Why a crypto data lake is worth it, even on a tight budget If you hack together scripts every time you need prices or on-chain metrics, you’re basically burning time as if it were free hardware. A crypto data lake gives you one…

-

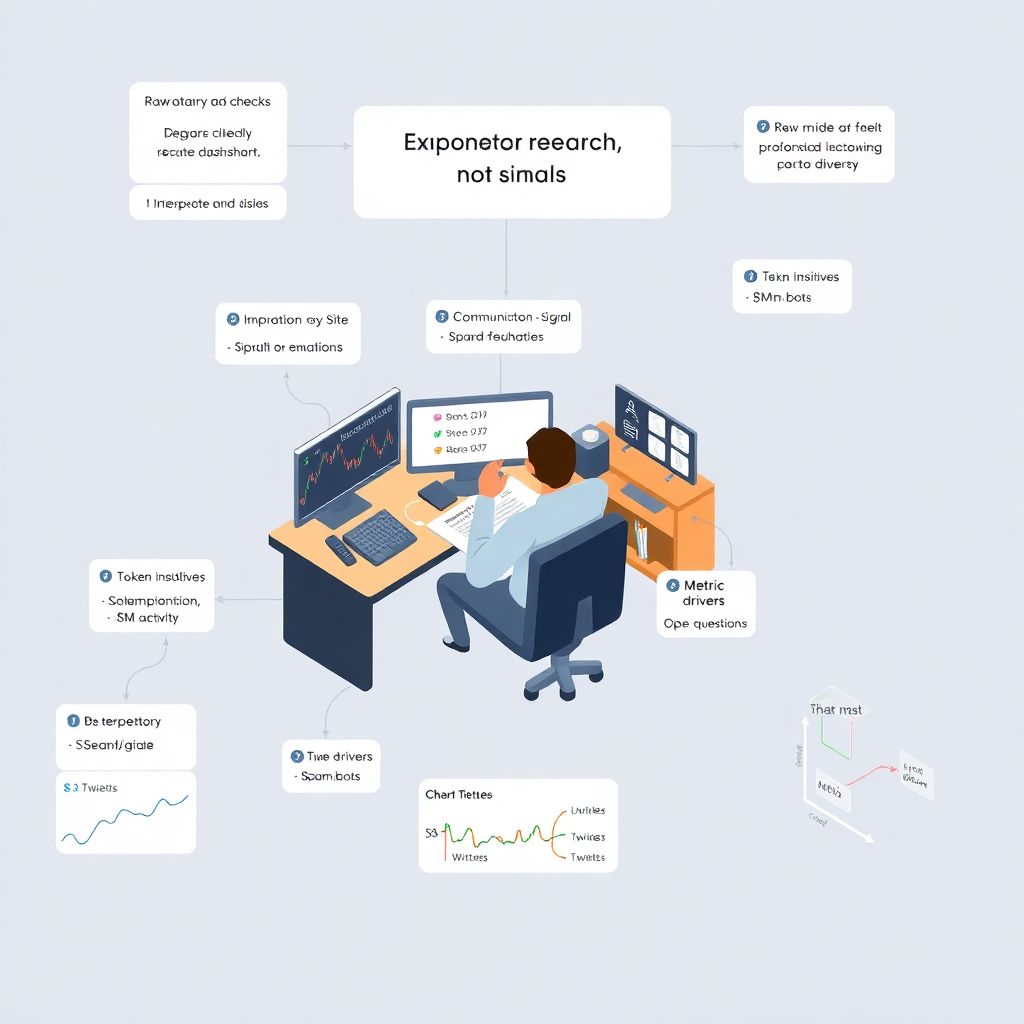

Tips for effective crypto research summaries for executives and better decisions

Why executive crypto summaries are a different beast Executives don’t want to become crypto analysts; they want fast, defensible decisions. Your job is to translate chaos from Twitter threads, on-chain dashboards and research calls into a clear signal. A good crypto market research report for executives cuts through hype, connects metrics to money, and shows…

-

From data collection to decision support in crypto investing

Crypto investing in 2025 is no longer just “buy Bitcoin and hope.” It’s a full data pipeline: raw feeds → structured datasets → models → dashboards → actual trading decisions. The distance between grabbing on‑chain data and pressing “Buy” is now filled with APIs, backtests, risk models and automated agents that never sleep. Below is…

-

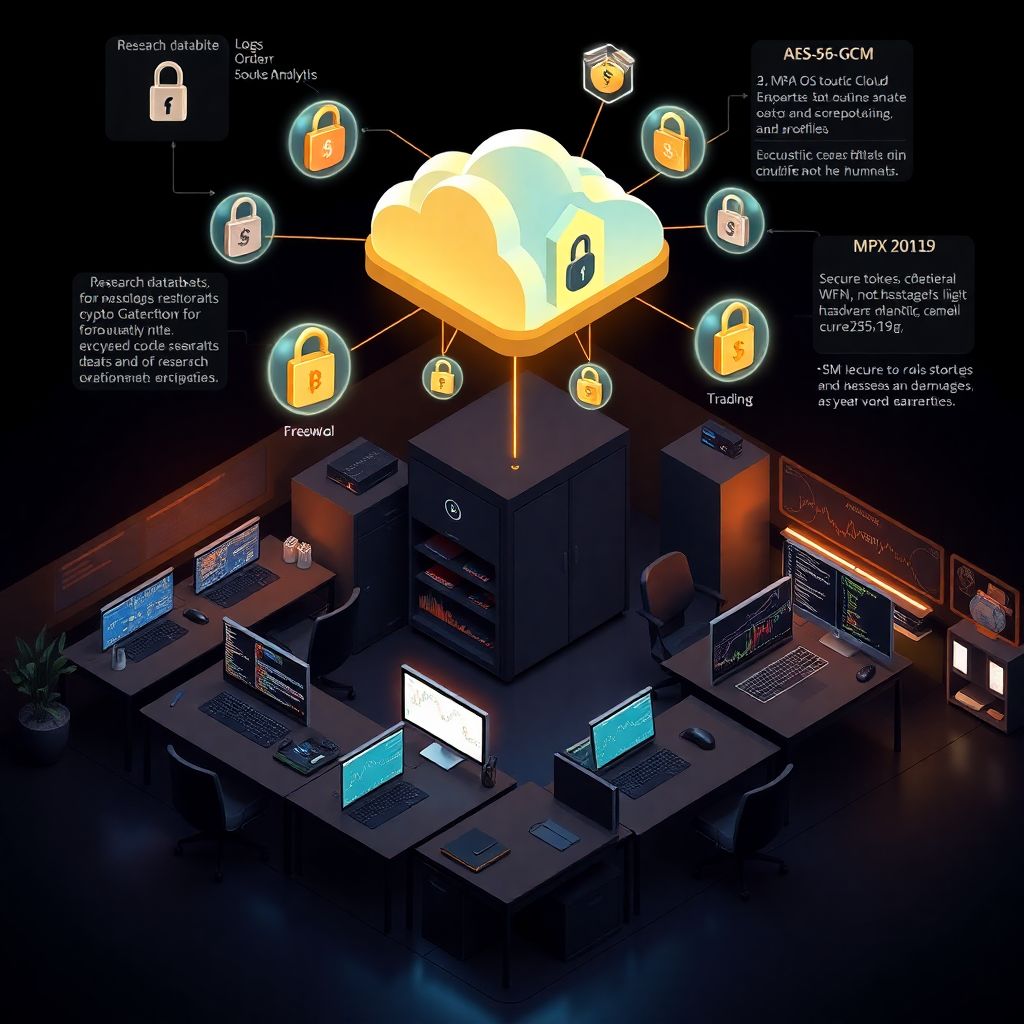

Tips for securing sensitive crypto research data in academic environments

Честно говоря, большинство утечек в крипто‑ресерче происходит не из‑за «гениальных» хакеров, а из‑за банальных ошибок: открытого Google Drive, общих паролей в команде, тестовых скриптов на продовом ноутбуке. Когда вы работаете с чувствительными данными — приватными ключами, проприетарными стратегиями, необнародованными метриками протоколов — цена ошибки измеряется не только деньгами, но и репутацией. Ниже — практические советы,…

-

Stablecoin analytics: navigating the complexities of digital asset stability

Understanding What “Stablecoin Analytics” Really Means Before diving into dashboards and charts, it helps to unpack what people actually mean when they talk about *stablecoin analytics*. Under this umbrella обычно скрываются несколько разных задач: отслеживание резервов и обеспечения, контроль рисков, анализ ликвидности и спрэда, изучение поведения трейдеров и оценка того, насколько выбранный стейбл действительно “стабилен”…

-

Best practices for sharing crypto research responsibly and protecting your audience

Why responsible sharing of crypto research actually matters The hidden impact of your “small” thread Even if you have a tiny audience, every chart, tweet or Discord message with “alpha” can start a chain reaction in thin crypto markets. A casual “looks bullish” on an illiquid token may prompt a few followers to ape in,…