Category: On-Chain Metrics

-

How to build a crypto analytics product that truly educates your readers

Why a crypto analytics product should teach, not just chart Most crypto dashboards feel like airport cockpits: flashy, dense, and quietly hostile to anyone who isn’t already an expert. If вы хотите построить продукт, который действительно объясняет, а не просто заваливает графиками, нужно смотреть на него как на «интерактивный учебник с реальными деньгами», а не…

-

How to build an accountable Ai system for crypto research and reliable market insights

Understanding what “accountable AI” really means in crypto Accountability in AI for crypto‑research is less about building a magical oracle and more about making every decision traceable, explainable and revisitable. When you run a backtest, trigger an alert on-chain, or flag suspicious flows, you should be able to answer three questions: why did the model…

-

Measuring the impact of token burns on network activity and on-chain performance

Why bother measuring token burns at all Token burns sound simple: send tokens to an irrecoverable address, reduce supply, enjoy the upside. In practice, if you want real data instead of narratives, you need a measurement framework that explains how token burns affect blockchain network activity and, indirectly, user behaviour. Step 1 is to treat…

-

How to monitor on-chain transaction anomalies at scale with effective automation

Why anomaly monitoring at scale hurts more than it should If you track just a few wallets, “monitoring anomalies” feels easy: plug into an explorer, set alerts, done. At scale — hundreds of chains, millions of addresses, layered bridges, MEV bots — everything breaks. Latency creeps up, false positives explode, compliance teams drown in alerts…

-

Price impact modeling for large trades: a practical guide

Why price impact matters way more than you think When traders обсуждают качество исполнения, многие по привычке смотрят только на комиссию брокера и спред. Но как только размер заявки становится заметным для рынка, главный враг — это уже не комиссия, а скрытая стоимость проскальзывания и рыночного влияния. Для крупных сделок цена начинает «убегать» от вас…

-

Practical introduction to cryptoeconomics for researchers and real-world examples

Why cryptoeconomics matters for researchers right now Cryptoeconomics звучит модно, но по сути это просто исследование того, как экономические стимулы и криптографические механизмы управляют поведением людей в децентрализованных системах. Если вы привыкли к классическим моделям — рынки, контракты, институты, — здесь всё то же самое, только вшито в код и работает в реальном времени. Блокчейн,…

-

Understanding protocol exhaustion and its critical trading implications

Why “Protocol Exhaustion” Is Suddenly on Every Trader’s Radar in 2025 Most traders in 2020–2021 never even heard the phrase “protocol exhaustion”. Fast‑forward to 2025, and it pops up in research notes, X (Twitter) threads, and in advanced on-chain dashboards. The market finally realized: protocols get tired too — not in a human sense, but…

-

Using Ml to enhance crypto market forecasting and improve trading decisions

Why machine learning and crypto are a natural match in 2025 Cryptocurrency markets в 2025 году стали еще более турбулентными: круглосуточная торговля, тысячи токенов, бесконечный новостной поток, крупные киты, которые двигают цену за секунды. Человеку отследить все это вручную фактически нереально. Именно поэтому идея использовать machine learning algorithms for cryptocurrency price prediction выглядит не модным…

-

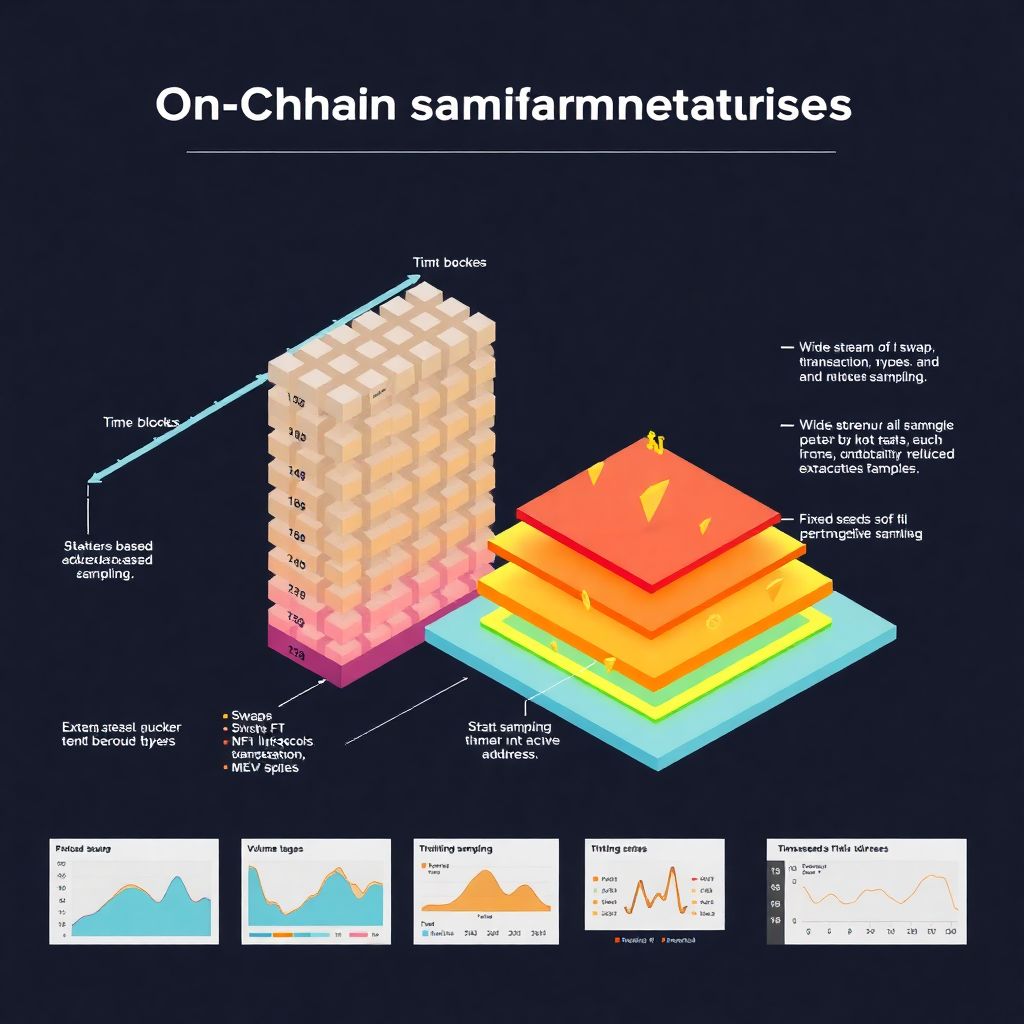

Practical guide to on-chain data sampling strategies for blockchain analytics

When people first dive into on-chain data, they usually try to “download everything and figure it out later”. That almost always ends in timeouts, broken dashboards and confused conclusions. A practical guide to on-chain data sampling strategies starts from the opposite side: decide what question you’re answering, then design how exactly you’ll peek into the…

-

How to detect token leakage and insider trading signals in crypto markets

Why token leakage and insider trading still matter in 2025 If you work around crypto, you’ve probably seen it: a random illiquid token pumps 40% on no news, then three hours later a listing or partnership drops. Or a “private” token allocation magically appears on-chain right before a treasury announcement. That’s token leakage and insider…