Category: On-Chain Metrics

-

From raw data to publish-ready crypto reports: streamline your reporting workflow

Why “Raw” Crypto Data Is So Painful To Work With Let’s be honest: crypto data in its raw form is a mess. You pull trades from one exchange, balances from another, some on-chain info from a block explorer, maybe a few CSVs from a wallet — and suddenly your “simple” crypto report looks like a…

-

Collaborative crypto research community driving innovation in blockchain science

Что вообще такое collaborative crypto research community Collaborative crypto research community — это не абстрактный чат про «какой токен завтра выстрелит», а устойчивая среда, где люди системно разбирают блокчейн‑проекты, проверяют гипотезы и делятся результатами. Вокруг этого выстраивается crypto analysts collaboration network: аналитики, разработчики, трейдеры, ончейн‑исследователи, юристы и даже продукт‑менеджеры. Вместе они не просто «делятся мыслями»,…

-

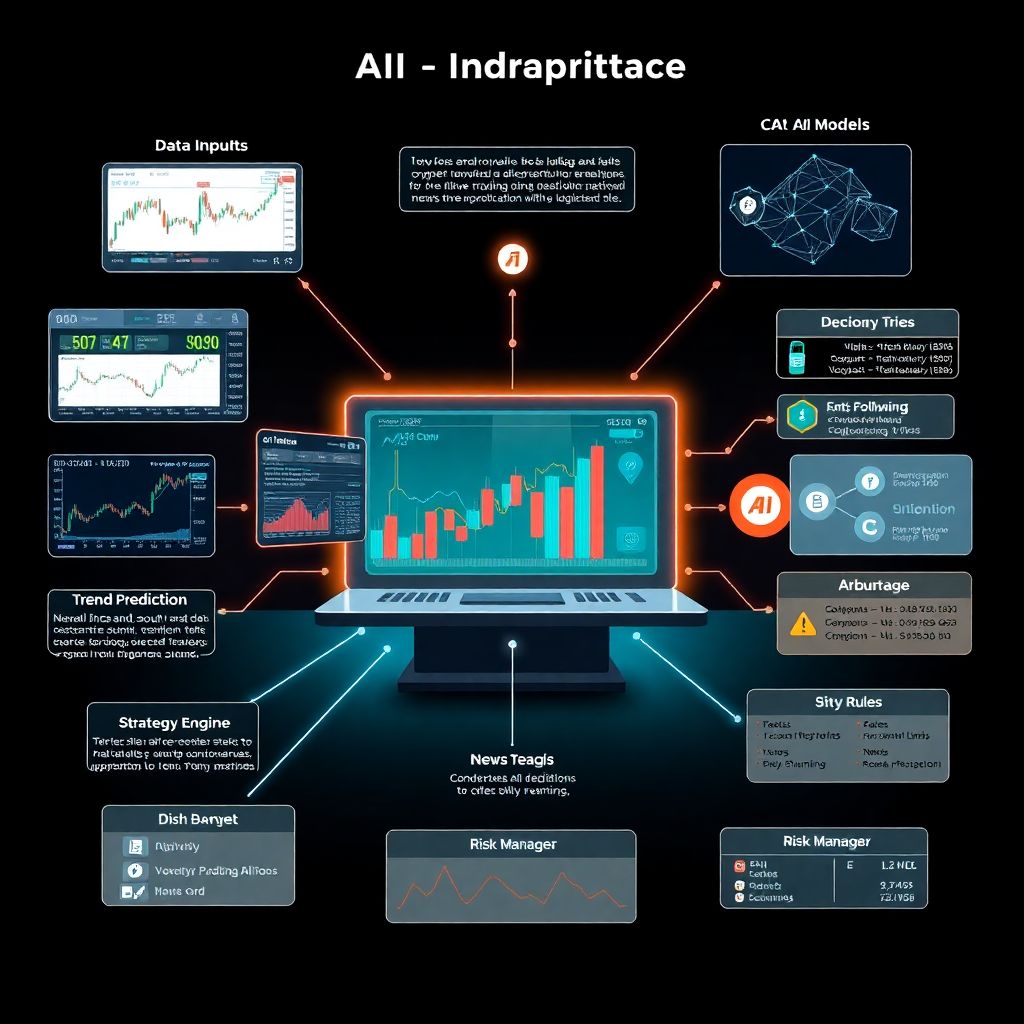

Ai-driven crypto insights: case studies of profitable trading and investment decisions

Why AI‑driven crypto insights matter AI в криптовалютах перестал быть игрушкой для гиков. Сейчас под этим понимают не магию, а конкретные модели: алгоритмы, которые просматривают графики, ордера, новости и соцсети быстрее, чем любой трейдер с тремя мониторами. Когда мы говорим про AI crypto trading strategies case studies, нас интересует не теория, а реальные истории, где…

-

How to use sentiment signals without bias in crypto research for better decisions

Why sentiment matters in crypto (and why bias ruins it) In crypto, sentiment moves faster than fundamentals: a single tweet, hack, or regulatory rumor can move billions in minutes. That’s why investors turned to market mood early, long before it was fashionable in equities. Forums like Bitcointalk and Reddit were primitive, but they showed that…

-

How to validate defi protocol uptime and reliability for safer investing

In 2020, when “DeFi summer” exploded, nobody seriously talked about uptime; everyone chased APY. By 2025, after multiple oracle outages, mempool congestion waves and a few brutal governance failures, reliability stopped being a boring SRE term and turned into a core investment metric. Validating DeFi protocol uptime and reliability now means mixing on‑chain data, off‑chain…

-

Guide to liquidity crunch indicators in defi risk analysis

Why liquidity crunch indicators in DeFi matter more than ever By 2025, децентрализованные финансы прошли путь от игрушки энтузиастов к полноценной инфраструктуре, через которую каждый день проходят миллиарды долларов. При этом большинство крупных провалов в DeFi за последние годы были не «внезапными катастрофами», а постепенными ликвидностными сжатиями, которые просто игнорировали до последнего. Понять, как работает…

-

Best data visualization practices for crypto dashboards that boost clarity and insight

Why data visualization makes or breaks a crypto dashboard If you’ve ever stared at a crypto dashboard and felt more anxiety than insight, you’ve seen bad visualization in action. In a market where BTC can move 5–10% in minutes and funding rates flip sentiment in under an hour, the way data is shown is as…

-

Evaluating yield farming streams with analytics for smarter defi returns

Why analytics decide whether your yield farming is alpha or noise Most yield farmers still chase screenshots of crazy APY instead of checking whether a stream is actually profitable after gas, slippage and impermanent loss. On a quiet week in 2024 I audited three wallets that were “killing it” on Arbitrum farms: only one was…

-

Investor sentiment signals from on-chain activity: how blockchain data reveals trends

Investor sentiment in crypto is weird: you can’t call a CEO hotline, but you can literally see wallets moving millions in real time. That’s the whole point of investor sentiment signals from on-chain activity — instead of guessing emotions from tweets, you infer crowd behavior from capital flows, gas usage, and smart‑contract interactions. In practice…

-

Designing an accountable crypto analytics product with transparency and trust

Why “accountability” in crypto analytics suddenly matters Accountability in crypto used to mean “we’ve got a slick dashboard and an audit log somewhere in the settings.” Today это уже не работает. Regulators want clear attribution, institutions want explainable risk scores, and users want to know, кто именно принимает решения: алгоритм, аналитик или комплаенс-отдел. When you…