Category: On-Chain Metrics

-

Mean reversion strategies in crypto markets: how to profit from price corrections

Why mean reversion still matters in 2025 In 2021–2022 казалось, что mean reversion в крипте умер: тренды по 300–500% за пару месяцев, мем‑альты, DeFi‑памп‑энд‑дампы. Но к 2023–2025 рынок сильно повзрослел. Объёмы сосредоточились на нескольких крупных биржах, маркетмейкеры стали агрессивнее, а волатильность внутри дня распределилась более “нормально”. В таком окружении спекулянты снова потянулись к идее, что…

-

Tutorial: building a tokenomics dashboard for tracking crypto project metrics

If you’re trying to make sense of token flows, vesting, and on‑chain activity instead of just staring at price charts, building a tokenomics dashboard is one of the most useful things you can do in 2025. Let’s walk through the landscape: what to build, which stack to pick, how different approaches compare, and where this…

-

Risk management techniques for leveraged crypto trading to protect your capital

Mindset of a Leveraged Trader in 2025 Why Leverage Feels Different Now Leveraged crypto today — это уже не дикий запад 2017‑го. В 2025 году у нас есть on-chain деривативы, perp DEX с cross‑margin, AI‑боты, автодепозиты под залог NFT. Всё это увеличивает потенциал профита, но и усиливает поведенческие ловушки: FOMO, overconfidence, revenge trading. Настоящая игра…

-

Comprehensive guide to defi protocol risk dashboards for smarter crypto investing

Why DeFi risk dashboards became a must‑have (and not just a nice extra) If you were around DeFi in 2020–2021, you probably remember how people “managed risk” by staring at Etherscan, a couple of Dune charts and a Telegram channel shouting about exploits. That worked until it didn’t. A few high‑profile hacks, cascading liquidations and…

-

Best practices for documenting crypto research processes for reliable analysis

Why documenting your crypto research matters more than ever In 2025, the crypto market looks nothing like the wild west of 2017 or even the manic DeFi summer of 2020. There are regulated exchanges, on-chain analytics dashboards, AI-driven sentiment tools and institutional-grade custody — но парадокс в том, что большинство частных инвесторов по‑прежнему работают «на…

-

Evaluating cross-chain liquidity risk in defi: methods and key metrics

Understanding Cross‑Chain Liquidity Risk Why cross‑chain risk is a big deal When you move assets across chains, you’re not really “sending ETH from chain A to chain B”. In most designs, you lock value on one side and mint a claim or IOU on the other. Your risk is not just “price goes down”, but…

-

Statistical techniques for crypto anomaly detection and fraud risk analysis

Why statistics still matter in crypto anomaly detection When people hear “crypto anomaly detection”, they often imagine magical AI that spots every scam in real time. In practice, almost every serious crypto anomaly detection software still relies on good old statistics at its core. Machine learning models usually sit on top of statistical features: z‑scores,…

-

How to conduct a robust crypto scenario analysis for smarter investment decisions

Scenario analysis in crypto sounds fancy, but in practice it’s just a disciplined way of asking: “What happens to my money if things go very right, very wrong, or just weird?” The goal is not to predict the future, but to map a few realistic futures and see how your positions behave in each. Done…

-

Forecasting crypto volatility with machine learning: methods and practical insights

Forecasting crypto volatility with machine learning sounds fancy, but at its core это просто попытка ответить на два вопроса: “Насколько сильно и как резко рынок может дернуться?” и “Что мне с этим делать в своей стратегии?”. Ниже — разбор без академического пафоса, но с вниманием к тому, что реально используют квантовые команды и продвинутые частные…

-

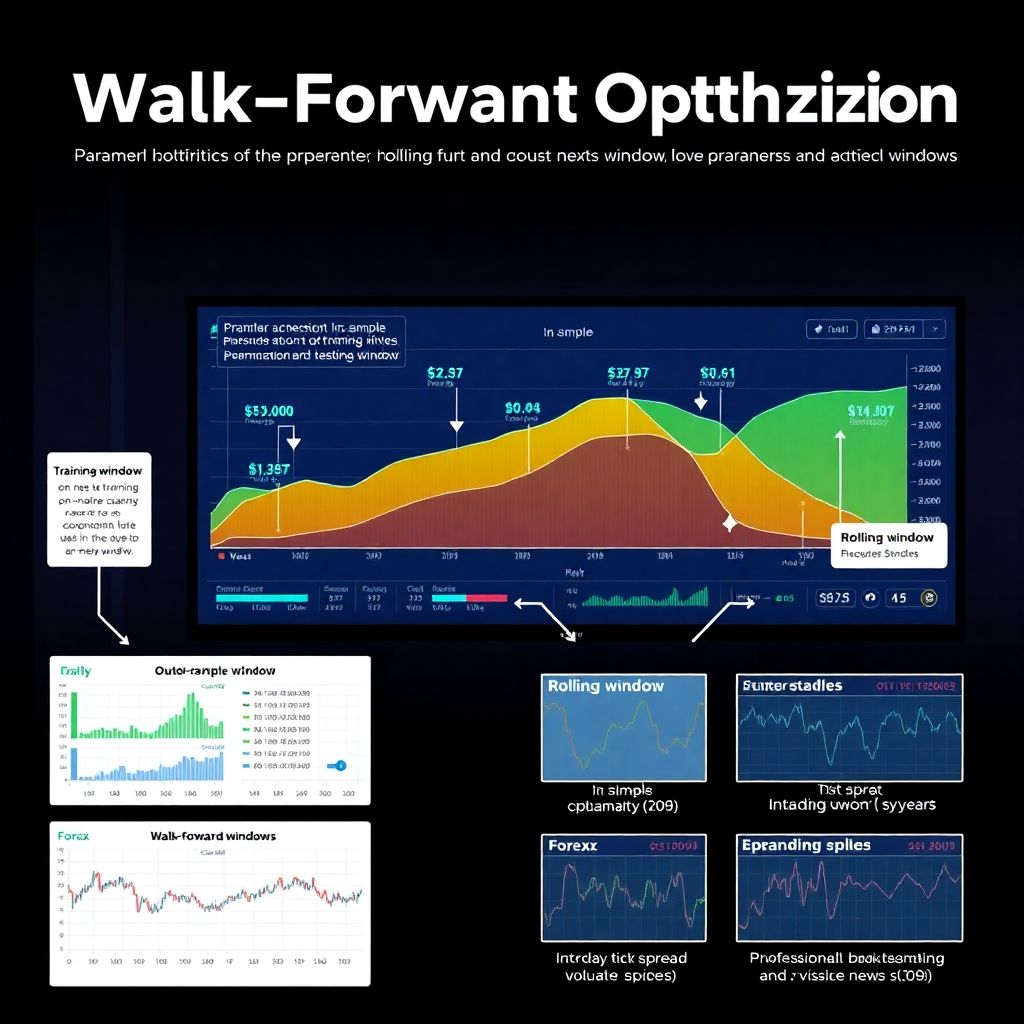

How to implement backtesting with walk-forward optimization in trading systems

Historical background of walk-forward optimization Before people started talking about walk-forward optimization, most traders did primitive backtests: they ran one test on all historical data, tuned parameters until the curve looked perfect, и happily went live. In the 1980s‑90s, systematic futures traders and early quants realized this approach was a minefield of overfitting. Firms began…