Why evaluating layer-2 isn’t just a “tech choice”

Layer-2 today is less about hype and more about survival. Fees, latency, and user patience are all shrinking. If you’re building anything on Ethereum (or any smart-contract chain), choosing the wrong scaling approach can quietly kill your project.

What complicates things: almost every marketing deck claims to be “fast, cheap, and secure.” So instead of a generic layer 2 blockchain solutions comparison, this guide focuses on how to think about real-world use cases, what can go wrong, and a few unconventional tricks that teams often overlook.

Let’s go step by step.

—

Step 1. Translate your use case into hard constraints

Before you read any docs, forget the tech names and answer four brutally practical questions:

1. How sensitive are you to security trade-offs?

– Are you moving serious value (DeFi, custody, RWA, payroll)?

– Or is it low-stakes (game items, loyalty points, voting in a DAO where outcomes are reversible)?

If the answer is “serious value,” you’ll likely want a rollup (optimistic or ZK) that inherits Ethereum security. For lighter stuff, you can consider more experimental or cheaper options.

2. What’s your latency tolerance?

Some apps genuinely don’t care if finality takes a minute. Others break if users wait more than a second for feedback.

Ask yourself:

– Is “soft” confirmation (UI shows success while the chain finalizes) acceptable?

– Do you need hard finality before letting the user proceed (e.g. financial trades, withdrawals)?

This question alone eliminates half the “best layer 2 scaling solutions for ethereum” for certain apps. For instance, a fast-paced game might be fine with a centralized sequencer plus optimistic finality. A derivatives protocol might not.

3. What is your cost per action ceiling?

Think in numbers, not adjectives.

– “Users won’t pay more than $0.02 per in-game action.”

– “We can afford $0.20 for a cross-chain bridge deposit.”

– “We need predictable fees for B2B contracts.”

Once you have a number, you can look at fee benchmarks and see which L2s are even in the running.

4. What is your regulatory and governance reality?

If you’re an enterprise or a regulated startup, you may need:

– Whitelisted participants

– Geo-fencing

– Data privacy guarantees

That’s where the debate layer 2 vs sidechain for enterprise blockchain becomes crucial: sometimes a permissioned sidechain with periodic settlement to Ethereum is more realistic than a fully public L2.

—

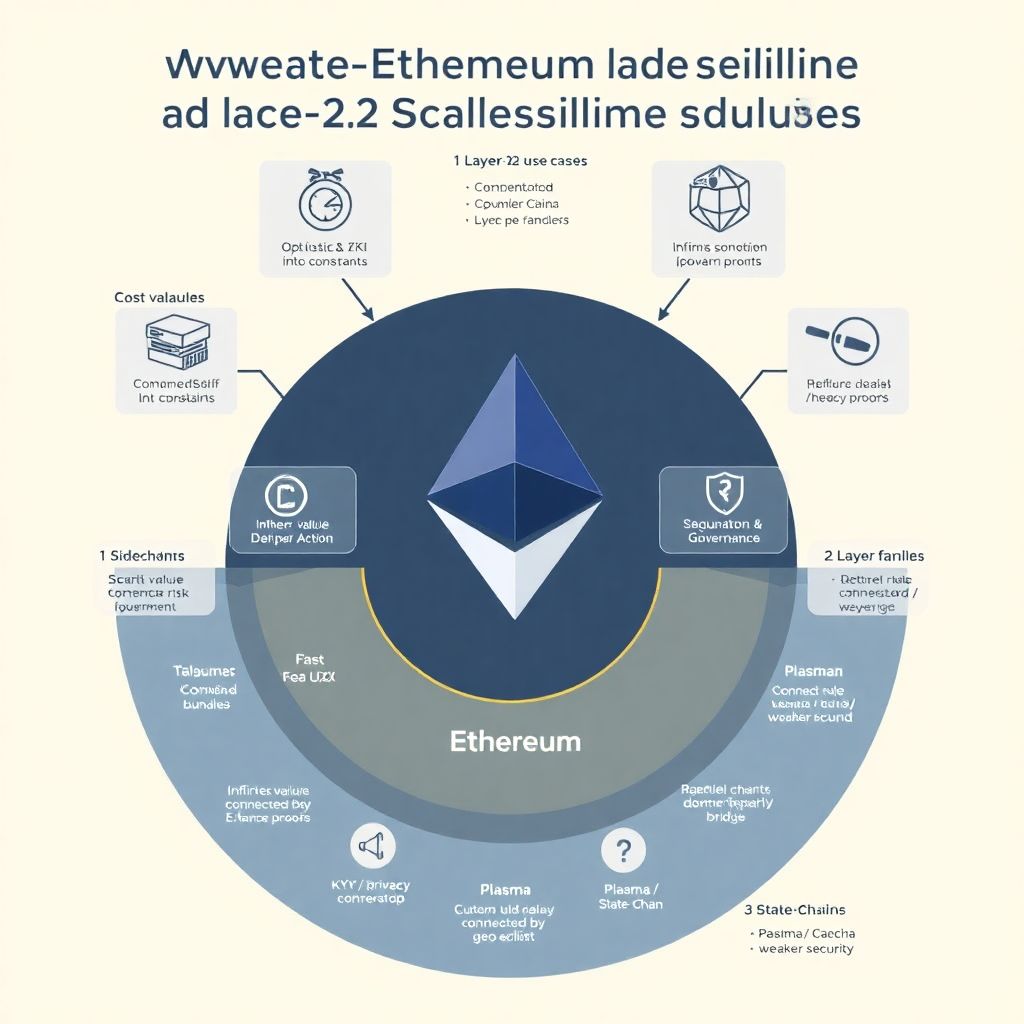

Step 2. Understand the main layer-2 families (without drowning in theory)

Let’s oversimplify first, then refine.

Rollups: the “Ethereum security with compression” approach

Rollups bundle lots of transactions, execute them off-chain, then post compressed data and proofs to L1.

– Optimistic rollups: Assume everything is valid unless someone proves fraud (dispute window).

– ZK-rollups: Use zero-knowledge proofs to show the whole batch is valid from the start.

Why they’re usually the top contenders in any layer 2 blockchain solutions comparison:

– Pros: Strong security (inherits Ethereum), widely supported tooling, long-term roadmap alignment with Ethereum.

– Cons: Still depend on sequencers (centralization risk today), withdrawal delays (optimistic) or heavy proof generation (ZK).

Sidechains: separate chains with a bridge

Sidechains run their own consensus and security, then bridge assets back to Ethereum.

– Pros: High flexibility, low fees, custom rules (e.g., KYC, permissions).

– Cons: Security is only as strong as the sidechain’s validators; bridge exploits can be catastrophic.

This is where layer 2 vs sidechain for enterprise blockchain trade-offs are very real: enterprises sometimes prefer governance control and custom rules over strict Ethereum-level security.

Plasma, state channels and friends: niche but not dead

You’ll hear arguments like rollups vs plasma vs state channels pros and cons. In practice today:

– Plasma: Good for simple value transfers; complex smart contracts are painful.

– State channels: Amazing for fixed sets of participants doing rapid interactions (e.g., repeated payments or in-game moves between two players).

– Validium / off-chain DA schemes: Keep most data off-chain, trust some committee for availability.

These are no longer the “headline” solutions, but they are powerful when matched to the right niche.

—

Step 3. Map layer-2 types to specific real-world patterns

Instead of asking “Which L2 is best?”, ask: “What pattern does my app fit into?”

Pattern A: High-value DeFi, treasuries, RWAs

You care about:

– Security > everything

– Predictable behavior in stress conditions

– Good composability with other DeFi apps

You generally want:

– A major rollup with strong liquidity and battle-tested infrastructure.

– As few experimental components as possible.

Unconventional move:

Use dual routing — execute trades on a rollup but settle key positions periodically on L1 (or another rollup) as a “vault of last resort”. This way, even if the L2 has downtime, your long-term collateral accounting is safe on a more conservative layer.

Pattern B: Mass-market consumer apps (games, social, loyalty)

Here the priorities flip:

– UX, speed, and near-zero fees matter more than “Ethereum-maximalist” security.

– You need near-instant feedback and cheap micro-interactions.

Options:

– High-throughput rollup with aggressive batching and cheap fees.

– Sidechain or appchain with periodic settlement to Ethereum.

– State channels for very chatty user interactions (e.g., head-to-head game actions).

Unconventional move:

Keep all valuable assets (currencies, rare items, identity) on a rollup, while game actions live on a super-cheap sidechain or even a centralized server with signed moves, periodically snapshotted to the rollup. Users enjoy “Web2-level” speed, but you don’t sacrifice asset safety.

Pattern C: B2B or enterprise workflows

Think supply chains, interbank messaging, B2B settlement, insurance data.

Priorities:

– Compliance, privacy, auditability.

– Control over participants and uptime.

You might choose:

– A permissioned sidechain or consortium chain bridged to Ethereum.

– An optimistic or ZK-rollup with permissioned accounts and private data layers.

Unconventional move:

Run a private rollup where all sequencers and data availability nodes are controlled by vetted institutions, but periodically commit checkpoints and summaries to Ethereum. This hybrid gives you enterprise governance and “provable” oversight.

—

Step 4. Do a structured “layer 2 blockchain solutions comparison”

Instead of reading 50 blogs, build a shortlist of 3–5 candidates and grade them along a few axes.

Key criteria (beyond the sales pitch)

– Security inheritance: Are you trusting Ethereum, or a custom validator set, or a committee?

– Data availability model: On-chain (more secure, more expensive) vs off-chain (cheaper, new risks).

– Ecosystem maturity: Tooling, wallets, oracles, bridges, monitoring.

– Economic sustainability: Fee model today vs long-term; token incentives vs organic demand.

– Exit strategy: What happens if the L2 stops working or loses support?

You don’t need perfect numbers, but you do need a clear ranking based on your constraints from Step 1.

—

Step 5. How to choose layer 2 solution for dapp scaling (without getting lost)

Let’s make this more concrete. Combine the previous steps into a practical selection process.

1. Write a one-page “L2 requirement spec”

Include:

– Target TPS and median latency.

– Max acceptable fee per transaction.

– Required security level and threat model.

– Regulatory constraints (KYC, data protection).

– Interoperability needs (which chains must you talk to?).

This alone will eliminate some options.

2. Shortlist and sanity-check

Pick 3–5 candidates that:

– Fit your rough constraints.

– Have at least one real application in production similar to yours.

– Provide clear, public documentation on their architecture and roadmap.

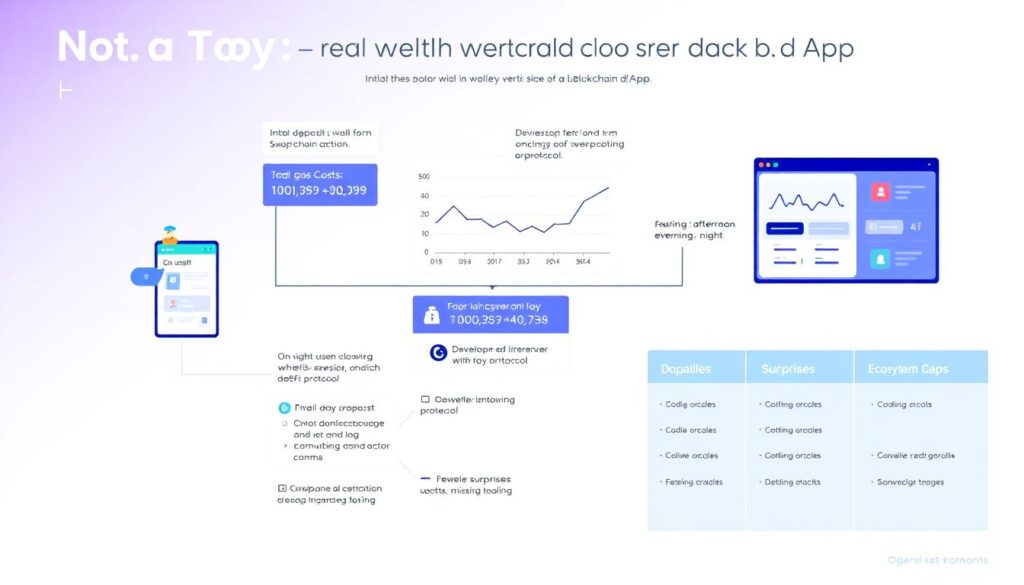

3. Build a minimal vertical prototype on 2 options

Not a toy. A vertical slice:

– One real user flow (e.g., deposit → action → withdrawal).

– Real gas costs measured at different times of day.

– Observations on dev experience, debugging, monitoring.

Then compare:

– Which one gave you fewer surprises?

– Where did you hit ecosystem gaps (oracles, bridges, library support)?

– How comfortable are you with the security story?

—

Step 6. Common mistakes and how to avoid them

Beginner mistake #1: Choosing by brand and TVL alone

“X has the biggest TVL, let’s build there.” Popular, but dangerous.

What to do instead:

– Check incident history: outages, censorship, MEV issues.

– Look at diversity of apps: Is it all yield farms, or a healthy mix?

– Read at least one skeptical analysis from an independent researcher.

Beginner mistake #2: Ignoring data availability

Many developers obsess over throughput and ignore where the data actually lives.

Risks:

– If data availability is off-chain and the committee fails or colludes, users may be unable to reconstruct the state reliably.

– For regulated apps, opaque data layers can create audit problems.

Tip: For any candidate, you should be able to answer, in one sentence:

If all operators disappeared, how would users recover their funds and state?

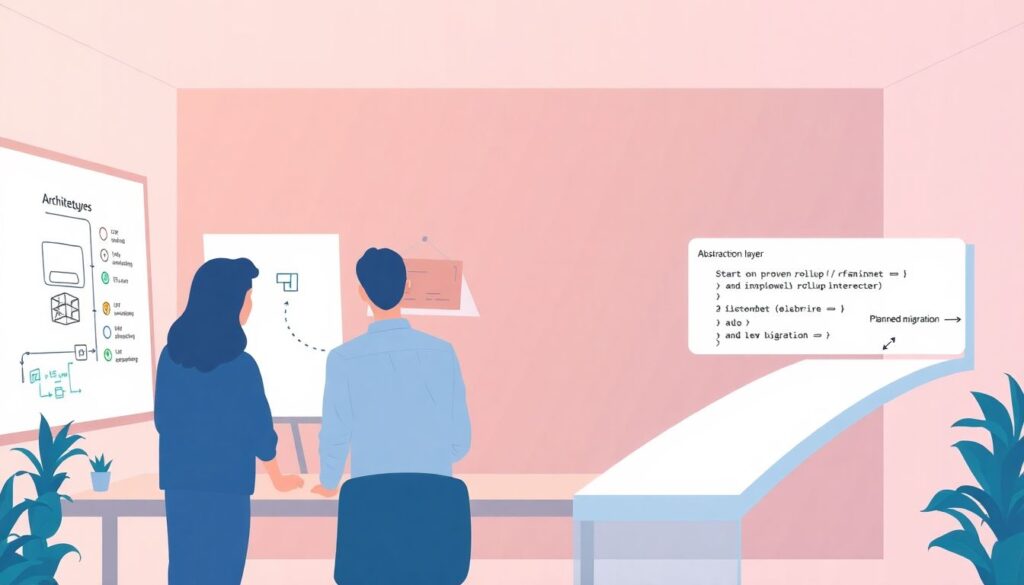

Beginner mistake #3: Over-optimizing early

Teams often spend months debating architecture for a product that doesn’t even have its first 100 users.

Better approach:

– Start on a well-known rollup or mainnet with L2-friendly design.

– Build an abstraction layer in your code so you can move chains later.

– Plan for migration, but don’t over-engineer for 1M users before you have 1,000.

—

Step 7. Unconventional strategies that actually work

Let’s go beyond the standard “pick one L2 and hope for the best” strategy.

Strategy 1: Multi-layer architecture by user segment

Not all users are equal. Design your system so:

– High-value or institutional users operate on a conservative rollup (or even L1) with stricter safety and higher fees.

– Casual users or “freemium” flows run on a cheaper, faster L2 or sidechain.

You can bridge between these tiers periodically, but each segment gets the UX and security that fits them.

Strategy 2: “Shadow rollup” for audit and recovery

Even if you build on a sidechain or centralized sequencer, run a shadow rollup:

– Every critical state transition (balances, ownership, key agreements) is periodically submitted to a minimal, low-frequency rollup or even L1.

– In a catastrophic event (sidechain failure, censorship), you can reconstruct user state from this shadow layer.

This is like version control for your blockchain state.

Strategy 3: Hybrid channels + rollup combo

For extremely chatty interactions (trading bots, high-frequency games, IoT messages):

– Use state channels or off-chain message queues for rapid back-and-forth.

– Only settle the net result periodically on a rollup.

This drastically reduces cost and on-chain noise, but keeps the economic result verifiable.

—

Step 8. Evaluating “rollups vs plasma vs state channels pros and cons” in 2025+ context

In the early days, all three looked like competing futures. Today, they’ve become specialized tools.

Rollups

– Best for: General-purpose smart contracts, public DeFi, NFTs, composable ecosystems.

– Watch out for: Sequencer centralization, bridge risk, and real-world finality delays.

Plasma

– Best for: Simple, high-volume token transfers or specific custody scenarios.

– Watch out for: Limited smart-contract flexibility, complex exit games.

State channels

– Best for: Repeated interactions between known parties, like payment channels or P2P games.

– Watch out for: Poor fit for open, many-to-many apps; online requirements for participants.

The takeaway: you don’t need to pick a camp. Treat them as lego bricks, not political tribes.

—

Step 9. Practical tips for newcomers

What to do in your first 30 days

– Deploy a trivial contract (counter, token, or simple game) on at least two different L2s. See where dev experience is smoother.

– Measure real fees during high and low network activity. Don’t rely on marketing numbers.

– Join the technical Discords of your shortlisted networks and ask awkward questions about failure modes.

Red flags to take seriously

– A network that discourages questions about exits or data availability.

– Overly complex token economics with no clear fee logic.

– No independent audits of the bridge or rollup contracts.

Bullet-check before committing:

– Does the chain have at least one honest, critical external code audit?

– Can you explain its failure modes to a non-technical stakeholder in 5 minutes?

– Do you know the upgrade process and who holds admin keys?

If any of these is unclear, you’re not done evaluating.

—

Step 10. Putting it all together

Evaluating layer-2 scaling solutions for real-world use cases is less about memorizing buzzwords and more about designing around constraints: security, UX, cost, and governance.

In practice:

– Start from your app’s risk profile and UX requirements.

– Narrow down candidates with a structured layer 2 blockchain solutions comparison along security, data availability, and ecosystem maturity.

– Prototype on at least two options. Measure, don’t assume.

– Consider hybrid and multi-layer architectures instead of betting everything on one chain.

If you treat L2 not as monolithic “networks” but as modular tools you can combine, you’ll be far ahead of the projects that simply follow trends.