Why AI-driven workflows matter so much in crypto journalism

Crypto moves at a speed that makes traditional newsroom routines look ancient. A token can pump 200% and crash back to earth before an editor has even finished assigning the first draft. On-chain activity spikes in seconds, regulatory news drops overnight, and narratives flip on X (Twitter) in minutes.

In that environment, AI-driven newsroom workflows aren’t a “nice to have” — they’re survival gear.

According to the Reuters Institute’s recent surveys, more than half of newsrooms worldwide are already experimenting with AI for tasks like summarisation, transcription and basic drafting. At the same time, the global crypto market has hovered around the $2 trillion mark in 2024, with 24/7 markets and a constant firehose of information from exchanges, L2s, DAOs and regulators. Manually monitoring and processing all that is simply impossible.

So the real question isn’t “Should we use AI?” but “How do we build AI workflows that help crypto journalists be faster and more accurate — without turning the newsroom into a content mill of shallow auto-generated junk?”

Let’s unpack several approaches and compare how they actually work in practice.

—

Approach #1: AI as an assistant layered onto existing workflows

What this model looks like day to day

In the “assistant” approach, you keep your existing editorial process mostly intact — editors, reporters, copy desk, legal — and you carefully plug AI into specific steps. Think of AI as a smart intern who never sleeps, not as a replacement editor-in-chief.

A typical flow might look like this:

1. AI monitors crypto data and headlines in real time

2. Editors review AI alerts and assign stories

3. Reporters draft the article; AI helps with background, on-chain data, and structure

4. AI assists with fact-checking and consistency

5. Human editor does final review and publishes

Short version: humans still own judgment and voice; AI handles drudgery and speed.

Where AI tools slot in without breaking things

For many outlets, this is where AI tools for crypto journalism workflows feel the most natural. You plug in:

– Summarisation bots for earnings calls, protocol town halls, X Spaces

– LLM-based note-takers for developer AMAs and regulatory hearings

– On-chain analytics integrations that suggest patterns worth investigating

– Draft helpers that create outlines, not finished copy

This can be as light-touch as connecting an AI summariser to your RSS feeds and Slack, or as structured as an internal “AI desk” responsible for triaging signals from dozens of crypto sources.

Strengths of the assistant model

The benefits are pragmatic:

– Low risk of brand dilution. Humans still write the final text, so tone and standards stay consistent.

– Easy to explain to readers and regulators. “We use AI to assist, not to decide” is a clear message.

– Incremental ROI. You start small: save 20–30% of time on research and transcription, then expand.

Economically, this model tends to reduce operational costs per story by 10–25% in the first year (mostly time saved in research and monitoring), without touching the core headcount. For smaller crypto news websites, that can be the difference between breaking even and bleeding cash in a bear market.

Weaknesses: good, but not game-changing

The downside: you rarely unlock the full power of AI newsroom software for crypto news websites. Your throughput improves, but your fundamental capabilities don’t change much. You still miss some early on-chain signals, and your publishing cadence is constrained by human bandwidth.

In other words, this is a “safe but modest” approach. It’s a solid starting point, but not a competitive edge if your rivals are building more ambitious pipelines.

—

Approach #2: AI-centric newsrooms with human oversight

Flipping the script: AI first, humans last

Here, the workflow is inverted. AI tools sit in the driver’s seat for discovery, first drafts and even initial editorial decisions. Humans step in mainly for supervision, sensitive pieces and high-impact reporting.

A simplified AI-centric flow might look like this:

1. Automated monitoring. An AI-powered crypto news aggregation and publishing solution watches:

– On-chain transactions across major chains

– CEX and DEX order books

– Governance forums, GitHub activity, X, Telegram, Discord

– Regulatory feeds and court documents

2. Story generation. When the system detects anomalies (whale moves, unusual contract calls, big governance votes), it:

– Summarises what happened

– Pulls background on the protocol, team, previous incidents

– Drafts a short piece or news brief

3. Prioritisation & routing. An internal dashboard scores stories by:

– Market impact

– Novelty and risk

– Relevance to your audience

4. Human pass. Editors and reporters review AI-generated drafts, pick the ones that matter, and refine them.

This model tries to maximise volume and responsiveness while still leaving humans in control of the final message.

Why some crypto outlets love this model

For high-frequency crypto media brands — think “Bloomberg terminal, but for digital assets” — this approach can be transformative:

– Massive scale. One editor can supervise dozens of AI-generated news items per day.

– Coverage breadth. Niche chains, obscure governance proposals, odd NFT exploits — nothing flies under the radar.

– Data-native stories. You can auto-generate charts, stats and timelines from on-chain data as part of every brief.

From an economic standpoint, this can slash the marginal cost of additional coverage. Once the system is built, adding a new chain or protocol to the monitoring pool is far cheaper than hiring another full-time reporter.

Forecasts for AI in media back this direction: industry analyses project that AI-driven content automation may handle 30–40% of basic news updates by the late 2020s in financial and crypto sectors, especially for event-driven headlines and routine market recaps.

Critical weaknesses: error propagation and trust

But there are sharp edges:

– Error cascades. If the AI misinterprets an on-chain event (e.g., treasury rebalancing vs. rug pull), that mistake can quickly propagate into dozens of downstream articles and social posts.

– Ethical landmines. In crypto, false rumors can move markets. Auto-publishing even lightly-reviewed content around hacks, delistings or bankruptcies is legally and reputationally dangerous.

– Homogenisation. When everyone uses similar models and data sources, coverage can start to sound the same, eroding differentiation.

The reputational risk is the real constraint. One high-profile mistake involving a major token or exchange can wipe out years of brand-building — and invite regulator scrutiny around market manipulation, especially if headlines move prices.

—

Approach #3: Hybrid “human+AI” investigation and analysis desks

Going beyond headlines

The third approach doesn’t focus on generating more news, but on generating better journalism. Here, AI is embedded deeply into investigative and analytical work, not just short-form news.

Imagine:

– AI systems cluster wallet addresses, detect patterns in cross-chain flows and surface potential wash-trading or insider moves.

– Journalists use those signals as leads, pairing them with sources, off-chain documents and interviews.

– The resulting stories explain *why* something happened, not just *what*.

This is where the best AI content automation platforms for crypto media quietly earn their keep. They’re not just pushing out auto-written posts; they’re doing the heavy lifting of:

– Entity resolution (who’s behind which wallets, where possible)

– Time-series anomaly detection across multiple chains

– Correlating price moves with governance, social sentiment and dev activity

The final article might still be 100% human-written — but most of the deep pattern discovery is AI-augmented.

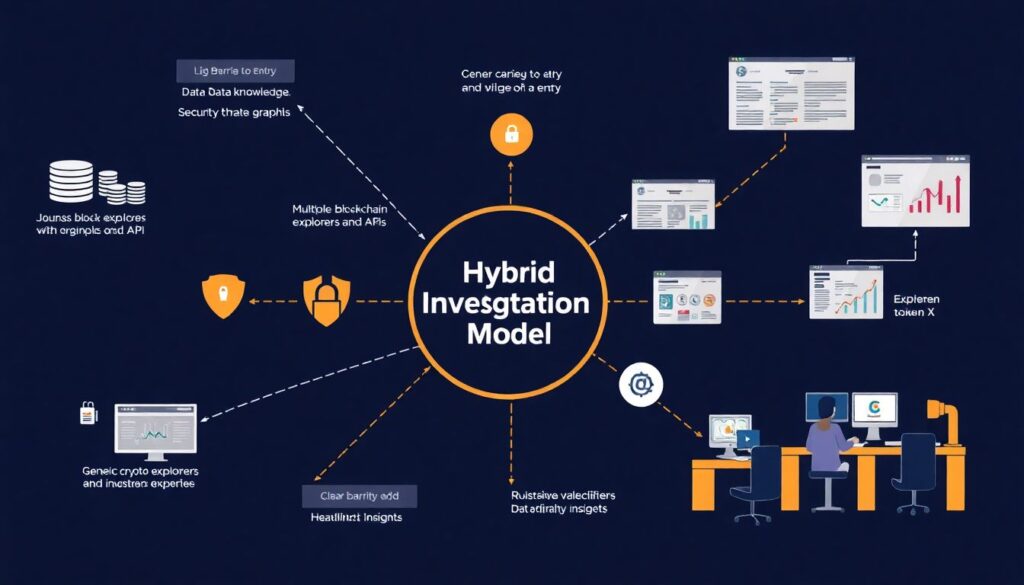

Why this model can be a strategic moat

This hybrid investigation model is harder to copy:

– High barrier to entry. You need data engineering, security knowledge, access to multiple block explorers and APIs, and tight collaboration between journalists and technical staff.

– Clear value-add. Readers can see the difference between “token X pumped 40%” and “token X pumped 40% because VC fund Y quietly accumulated 5% of supply across these wallets over three weeks.”

– Premium monetisation. Insightful, data-rich investigations can be packaged as paid newsletters, institutional research, or exclusive reports.

Economically, it’s the opposite of the AI-centric headline factory: higher per-story cost, but higher average revenue per reader. For outlets targeting funds, sophisticated traders or compliance teams, this approach often makes far more sense than chasing raw traffic.

The trade-offs

The obvious downside is capacity. You will publish fewer pieces than a highly automated outlet. Your newsroom must be comfortable saying: “We’ll let others race on speed; we’ll race on depth.”

This can feel counterintuitive in a market obsessed with real-time updates, but over a multi-year horizon, strong investigative capacity can define a crypto brand’s authority — especially as regulators, institutional players and serious builders increasingly look for rigorous, data-backed reporting.

—

Choosing your tech stack: build vs buy vs consult

Option 1: Off-the-shelf AI newsroom software

Buying ready-made AI newsroom software for crypto news websites can get you to market quickly. Many platforms now offer:

– Multi-chain data ingestion and alerting

– Headline and summary generators

– Simple workflow tools for assigning AI-found stories to humans

– Auto-posting to CMS and social channels (with configurable approval steps)

This is ideal if:

– You’re a smaller outlet with limited engineering capacity

– You care more about reliable coverage than ultra-custom analytics

– You want predictable costs (subscriptions instead of big capex projects)

However, off-the-shelf solutions tend to lock you into their data sources and model choices. Custom tweaks for niche chains, local regulators or unusual workflows can be expensive or impossible.

Option 2: Custom in-house platforms

Larger or more technical organisations may build their own internal AI platforms. That can include:

– Custom connectors to on-chain data, forums, legal filings

– Fine-tuned language models trained on your style guide and historical articles

– Bespoke dashboards that blend newsroom metrics (clicks, reads, subs) with on-chain and market data

Done right, this can become a long-term strategic asset. Your AI tooling reflects your editorial priorities, your audience and your risk tolerance.

The economic question is simple: can you justify the upfront cost? A decent internal platform may require a cross-functional team (ML engineer, data engineer, product owner, devops) for at least 6–12 months, plus ongoing maintenance. That’s rarely worth it for a single small publication, but it can pay off for a multi-brand media group or a research firm serving institutions.

Option 3: Bring in external expertise

If you don’t have strong AI and data teams in-house, it often makes sense to hire AI consulting for building crypto newsroom workflows. Specialized firms or independent experts can:

– Audit your current editorial processes

– Map out where automation helps and where it harms

– Evaluate vendors and help you avoid hypeware

– Design governance: human review thresholds, bias checks, incident response for AI-driven errors

Think of this as paying once to avoid three years of painful trial and error. Over time, many outlets move from consulting-heavy to product-heavy: they learn enough internally to steer and extend the system themselves.

—

Designing the workflow: practical steps and pitfalls

1. Start with a workflow map, not with tools

Before signing contracts or spinning up models, sit down with your newsroom and sketch the current state:

1. How do stories enter the pipeline now (tips, PR, on-chain alerts, social)?

2. Who touches the story at each stage?

3. Where do delays, errors or bottlenecks appear most often?

4. Which parts are genuinely creative, and which are mechanical?

Only after you have that map should you ask, “Where would AI save the most pain *without* damaging our standards?”

2. Classify stories by risk level

Not all content is equal. A quick explainer on how staking works has lower real-time risk than breaking coverage of a possible exchange insolvency.

A practical pattern is to define tiers:

1. Low risk. Educational content, evergreen explainers, glossary entries. High AI support is fine, with human review mainly for clarity and style.

2. Medium risk. Market recaps, funding rounds, routine protocol updates. AI may draft; humans must check facts, tone, conflicts.

3. High risk. Hacks, insolvencies, regulatory actions, whistleblower leaks. AI can help research, but humans should own every word from scratch.

Align your automation level with these tiers. This is where many “AI-first” newsrooms stumble: they let the same pipeline handle both a tutorial on gas fees and a possible billion-dollar exploit.

3. Build feedback loops into the system

An AI workflow is never “done.” Models drift, new chains launch, incentives change. You need:

– Regular accuracy audits: random sample checks of AI outputs vs verified facts

– Post-mortems on significant corrections or misfires

– Transparent metrics: what % of drafts were heavily edited, rejected, or led to corrections after publication?

Over 3–5 years, newsrooms that treat AI workflows as living systems — not one-off projects — are the ones that actually see compounding benefits.

—

Comparing the approaches: speed, depth, and trust

Speed vs. quality is not the only axis

Let’s compare the three main models in practical newsroom terms:

– Assistant model

– Pros: Low risk, relatively cheap, compatible with existing culture.

– Cons: Modest competitive edge; mainly a cost/time saver.

– Best for: Traditional outlets adding crypto coverage; small teams that value stability.

– AI-centric headline factory

– Pros: Huge volume, great for real-time dashboards and wire-style feeds.

– Cons: Higher risk, homogenised content, harder to differentiate.

– Best for: Quant traders’ feeds, terminal-style products, wire services.

– Hybrid investigative model

– Pros: Strong differentiation, premium audience, high trust potential.

– Cons: Slower cadence, requires serious technical competence.

– Best for: Deep-dive crypto media, institutional research shops, policy-oriented outlets.

In practice, many organisations operate a blend: AI-assisted general newsroom, semi-automated briefs and recaps, and a separate, heavily AI-augmented investigative unit.

Industry impact over the next decade

Looking forward, several trends are fairly clear:

– Commodity news will be almost fully automated. Prices, minor updates, superficial “X partners with Y” stories will be AI-generated and lightly edited, or even fully machine-published.

– Differentiation moves to analysis and trust. Readers, regulators and institutional players will pay for *reliability* and *interpretation*, not just raw information.

– Economic pressure intensifies. As low-level content costs approach zero, ad revenue will consolidate around a few big platforms. Smaller outlets must either specialise or partner.

Analysts expect the broader AI in media and entertainment market to grow at double-digit annual rates through 2030, but the distribution of benefits will be uneven: those who treat AI as infrastructure for better journalism will likely outcompete those who treat it purely as a content pump.

—

Putting it all together: a pragmatic roadmap

From zero to AI-driven, without losing your soul

If you’re starting from a mostly manual setup, a realistic 12–24 month path might look like this:

1. Phase 1: Instrumentation (0–3 months)

– Add monitoring and summarisation tools to your feeds and chats.

– Standardise style guides and editorial rules so models can learn them.

2. Phase 2: Assistant mode (3–9 months)

– Use AI for research, outlining, and basic briefs under strict human editing.

– Run small experiments with automated alerts and draft generation.

3. Phase 3: Structured automation (9–18 months)

– Formalise story tiers (low/medium/high risk).

– Allow semi-automated publishing for low-risk items with strong safeguards.

– Start building AI-augmented investigation tools if you have the audience for them.

4. Phase 4: Strategic refinement (18–24+ months)

– Decide where you want to compete: speed, depth, or niche specialisation.

– Invest selectively in custom tooling, integrations, or expert consulting.

– Keep tightening feedback loops and governance.

Along the way, you’ll likely test multiple AI tools for crypto journalism workflows, maybe pilot one or two best AI content automation platforms for crypto media, and eventually settle on a core stack that matches your editorial DNA.

The key is to remember that AI is not a monolith. It’s a collection of components — models, data streams, workflows, policies — that you can assemble in different ways. Crypto journalism, with its mix of code, markets and politics, is one of the best testbeds for this new kind of newsroom.

If you design those workflows thoughtfully, you don’t just survive the AI wave. You use it to build a newsroom that’s faster *and* more insightful than anything you could have imagined in the purely human era.